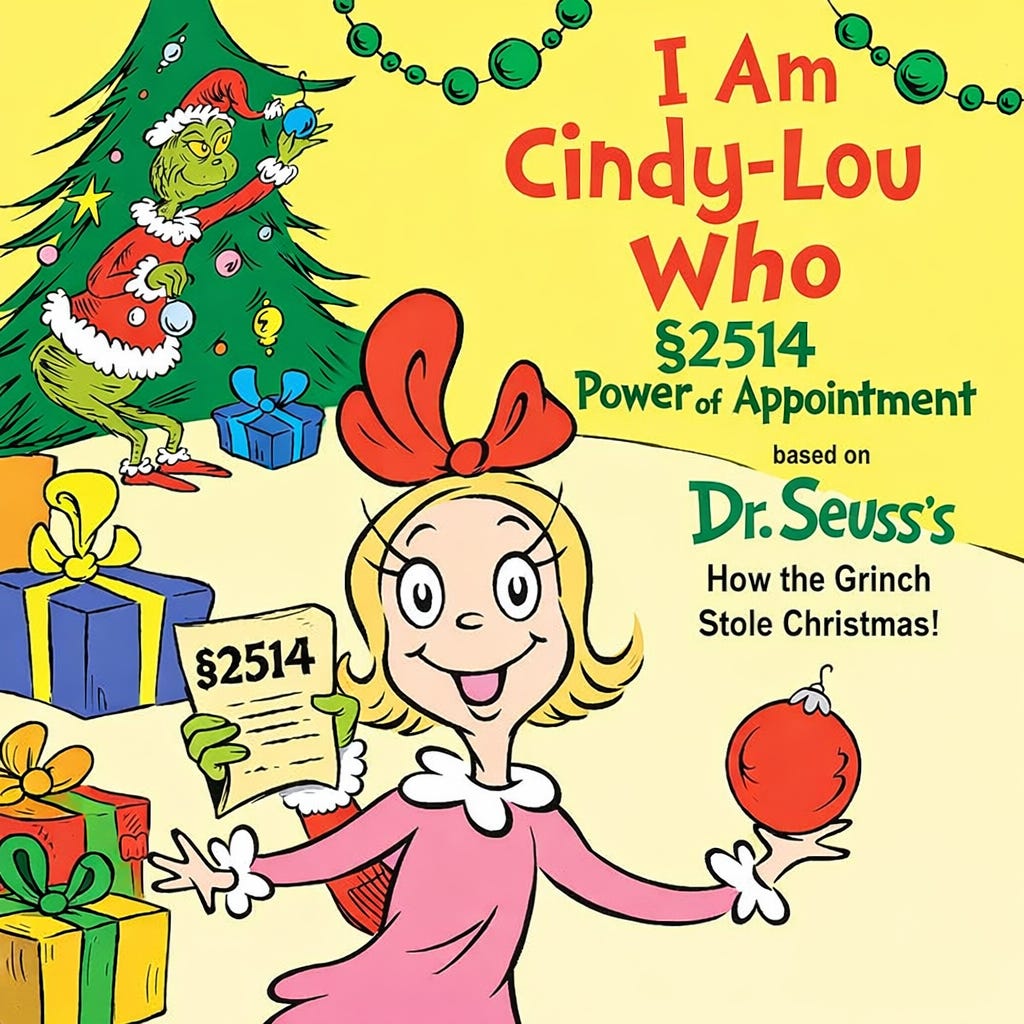

A Very Taxy Christmas: What the Grinch Has to Do With §2514, Powers of Appointment?

How the Grinch Gets Hit With Gift Tax Without Owning Anything at All

Can the Grinch get hit with gift tax without owning anything?

The insane (but true) answer: yes.

Welcome to §2514 — Powers of Appointment.

A tax rule so weird it feels like it was written by the Grinch himself.

What is a General Power of Appointment?

Think of it as the legal power to steal someone else’s stuff.

Not borrow.

Not admire.

Just steal.

Christmas Edition Example:

Santa, in a moment of questionable judgment, gives the Grinch a §2514 general power of appointment over Cindy Lou Who’s Christmas present — but only on Christmas Day.

That means the Grinch has the legal right to take Cindy Lou Who’s gift anytime he wants on Christmas.

Even though the gift isn’t his.

Even though he never touched it.

Even though it’s still sitting nicely under Cindy Lou Who’s tree.

Now, Here’s Where Tax Law Goes Full Grinch.

If the Grinch forgets to exercise that power — meaning he lets Christmas Day pass without stealing the gift — the law says he has “lapsed” his power of appointment under §2514(e).

And that lapse is treated as… a GIFT!!!

Yes. A taxable gift.

Made by the Grinch.

Of a present he never owned.

Tax fiction at its finest.

But wait — Santa did give us a tiny bit of holiday mercy.

The first $5,000 of a lapsed general power of appointment is ignored.

So:

If Cindy Lou Who’s present is worth $5,000 or less → no taxable gift

If it’s worth $10,000 → $5,000 is treated as a taxable gift by the Grinch

Result:

The Grinch could owe gift tax

without owning a single Christmas present

just because he had the power to steal one

and forgot.

Did Santa write the tax code?

Unclear.

But §2514 proves one thing:

in tax law, even forgetting to be naughty can cost you.

Merry Christmas 🎄

In Dedication to

Prof. James Henderson, EsQ

and Jon Vaught, EsQ

Thank you for reaching me that even the Grinch can trigger gift tax.