For Tax Pros: The Tax Rule That Still Feels Wrong

IRC §2518 and Why Refusing Property Can Be the Correct Answer in Estate Tax Planning

Would you ever say “No” to a gift?

Especially when that gift is a $10 million?

Apparently, some people do.

That idea is unthinkable to me. I’m an immigrant who still says “no” to extra cheese at Five Guys to save a buck or two. Turning down $10 million feels borderline insanity.

So, when I first learned about IRC §2518, my reaction was like this guy.

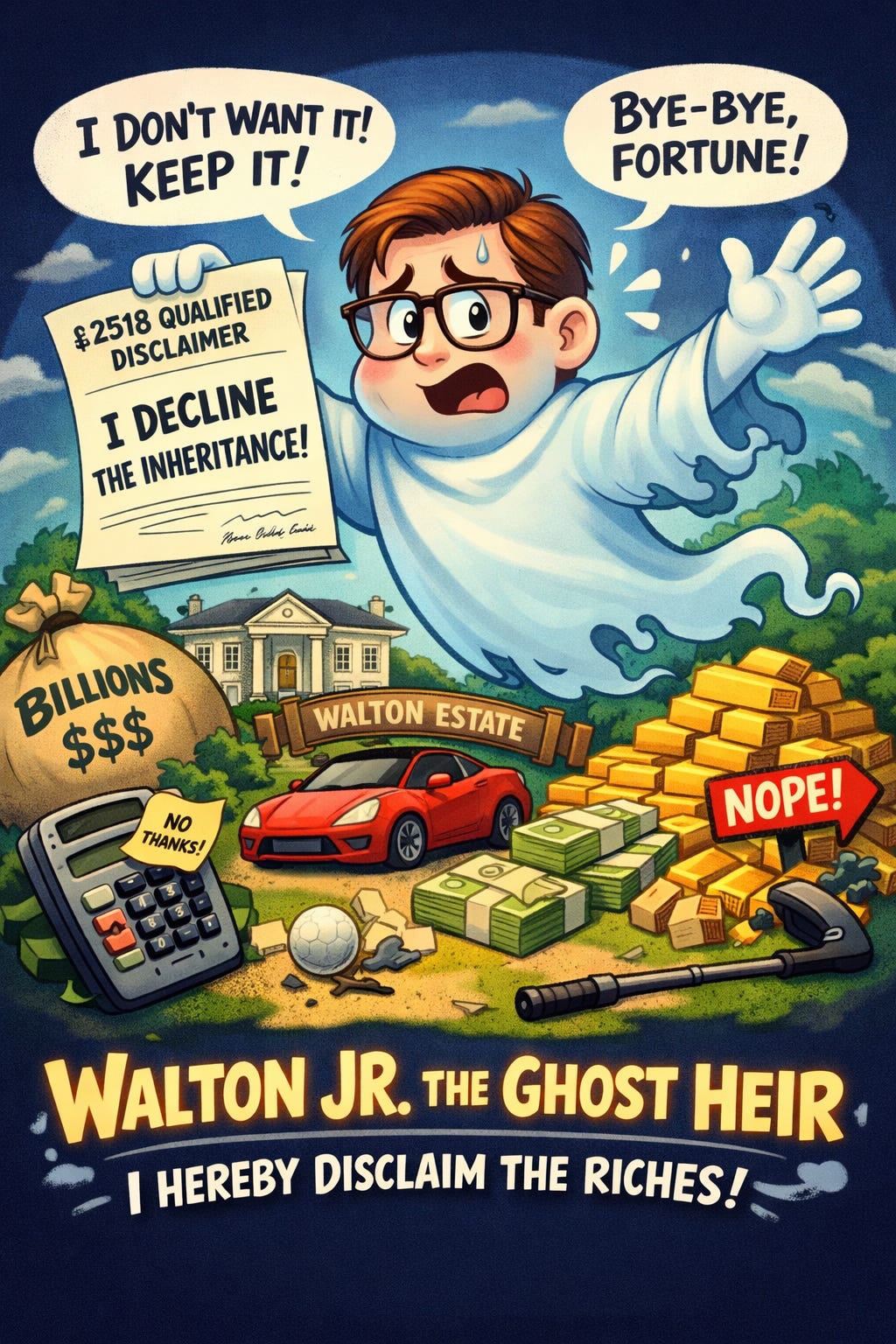

IRC §2518 (Qualified Disclaimer) is built entirely around refusing a gift you are legally entitled to receive.

It sounds absurd on its face. But for ultra-wealthy families, the “absurd” rule can be incredibly powerful. Accepting the gift can actually make their estate tax problem worse.

This is one of those provisions that only makes sense once you stop thinking like an individual and start thinking like a CFO of the Sam Walton Family.

The Problem With Simply Accepting the Inheritance

Let me show you where this concept actually works.

Imagine Papa Walton, a billionaire, owns a $10 million ranch in Arkansas. In his will, he leaves the ranch outright to his son, Walton Jr., who is already a billionaire himself.

If Walton Jr. accepts the ranch, the tax consequences are straightforward:

The ranch becomes part of Walton Jr.’s taxable estate

When Walton Jr. later dies, that extra $10 million is exposed to the notorious 40% federal estate tax - a $4 million tax bill.

From a family-wide tax perspective, this is inefficient. The asset is being stacked onto an estate that is already far above the estate exemption amount.

The Counterintuitive (Baller) Move: Saying No

A better move may be for Walton Jr. to refuse the inheritance entirely so that the ranch passes directly to the next beneficiary — children or grandchildren — who are not yet multi-millionaires subject to estate tax.

That refusal is called a qualified disclaimer under IRC §2518.

This is not “giving the property away.”

Instead, the tax law treats the transaction as if Walton Jr. never received the property at all. Conceptually, he is treated as if he were already dead for estate/gift tax purposes.

That distinction is everything.

If Walton Jr. never received the ranch since he is a ghost, then it never becomes part of his estate. No estate tax inclusion. No downstream estate tax exposure tied to him.

The Four Requirements Under §2518(b)

Congress was very precise about when this works. To qualify under §2518(b), all four requirements must be met.

First, the disclaimer must be in writing.

Second, it must be delivered within nine months of when the interest is created.

For inheritances, that is generally the decedent’s date of death.Third, the person disclaiming cannot accept any benefit from the property.

No income. No use. No enjoyment. No hunting on the ranch like you own it. Even partial acceptance destroys the disclaimer.Fourth, the property must pass automatically to the next beneficiary under the governing document - here, Papa Wilton’s will - without any direction or control by the person disclaiming (i.e., Walton Jr.)

You do not get to choose who receives it. You simply step aside. Quietly. Like a ghost.

The Tax Result When Done Correctly

If all four requirements are satisfied, the result is clean:

No estate tax inclusion for Walton Jr.

The property passes to the next beneficiary without transfer tax friction at Walton Jr’s level

From a planning standpoint, this can dramatically reduce long-term, intra-family estate tax exposure for ultra-wealthy families.

Why This Matters for Tax Pros

IRC §2518 is conceptually strange. Refusing wealth feels unnatural — especially to someone who grew up counting dollars like me.

But for families thinking in terms of total family net worth rather than individual inheritances, it can be one of the most elegant estate planning tools in the Code.

Sometimes the most tax-efficient move is not receiving more assets.

It’s knowing when — and how — to say no.

Even if you never expect to turn down a $10 million ranch yourself.

Tax Pros:

Have you ever used a qualified disclaimer in practice?

What were the circumstances — estate size, family dynamics, timing issues?

What was the real benefit: estate tax savings, GST planning, or family alignment?

Share your notes!

Excellent walkthrough of IRC 2518 mechanics. The qualified disclaimer strategy is fascinating because it flips the usual inheritance logic where people always feel obligated to accept assets. Back when I was helping with estate issues in a family business, the nine-month timing requiremnet became the real chokepoint more than conceptual resistance. People need time to evalaute if disclaiming actually makes sense given their own estate posture, but thats exactly the window that closes fastest.