The Tax Mechanism Behind "Front-Loading" a 529 Plan

For Tax Pros — Dissecting the Tax Code Like a Tax Surgeon

Tax Pros:

You all know that a grandparent (or anyone) can contribute up to five times the annual gift tax exclusion to a 529 plan for a grandchild and avoid gift tax.

But why is this allowed, and what’s the actual tax mechanism that makes this work?

The answer lives in IRC §529(c)(2)(B).

This provision allows a donor whose contribution to a 529 plan exceeds the annual exclusion under §2503(b) to elect to treat the contribution as having been made ratably over a five-year period for gift tax purposes.

This is the well-known “5-year election” or “front-loading” a 529 plan.

What’s important is that §529(c)(2)(B) does not increase the annual exclusion. Instead, it recharacterizes the timing of the gift.

Mechanically, here’s what’s happening:

The donor makes a single, large contribution (for example, $19,000 x 5) to the 529 plan in 2025.

For gift tax purposes only, that contribution is treated as if one-fifth ($19,000) were made in each of five consecutive calendar years, beginning in 2025.

Each annual slice is treated as a present-interest gift, allowing the §2503(b) annual exclusion to apply in each year.

This is not automatic.

It requires an election.

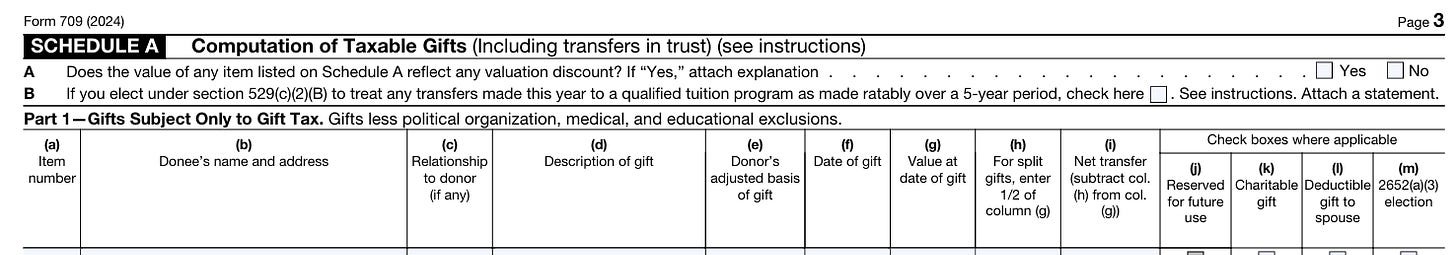

The donor must file Form 709 for the year of the contribution

The donor much check the election box on Schedule A, Part 1 (page 3), and attach the required statement identifying the beneficiary, the amount contributed, and the allocation across the five-year period.

Even if the donor owes no gift tax and uses no lifetime exemption, the return is still required to lock in the election

A subtle but critical point:

Once the election is made, the donor is treated as having made gifts in each of the four succeeding years (for example, $19,000 in 2026-2029), even if no additional cash is transferred in those years. As a result, the donor’s annual exclusion for the beneficiary is considered fully used for those years, unless the exclusion increases.

This leads to a frequently overlooked planning opportunity.

If the annual exclusion increases during the five-year spread period, the donor may make additional contributions up to the amount of the increase for each remaining year in the election period, without using lifetime exemption.

Example:

Assume a grandpa contributes $19,000 × 5 in 2025 for a grandson and properly elects the 5-year spread. If the annual exclusion increases to $29,000 in 2026, the grandpa may contribute an additional $10,000 in 2026 for that same beneficiary without gift tax consequences. That additional amount is treated as a present-interest gift for 2026 and does not retroactively affect the original election.

In Conclusion:

§529(c)(2)(B) is a deceptively short provision with real mechanism nuance. It’s one of the few places where Congress explicitly allows gift-tax timing to be bent, provided you follow the paperwork precisely.

Tax Pros:

Have you used the §529(c)(2)(B) five-year election in practice?

I’d love to hear real-world examples of how this provision has helped your clients—whether it was front-loading education savings, managing annual exclusions, or coordinating with larger estate plans.

What worked well?

What surprised you?

Any pitfalls or best practices you’d flag?

Let’s share notes and learn from each other.