Kenny Kim, EA, MD – Tax Educator & Tax Strategist

Life throws interesting twists and turns, and that certainly happened to me.

After many years of training as a medical student, emergency medicine resident, and palliative medicine fellow, I found myself falling in love with tax.

Tax - who would have thought?!

I never imagined that I would find U.S. tax law so intriguing and fascinating.

I live and breathe tax all day, every day. I can count on one hand the number of days I haven’t thought about tax since I started my journey as a tax professional in 2022 —it has simply become a part of me.

It still surprises me how excited I get when I discover tax codes and strategies that I can share with my fellow doctors. Sometimes, I feel even more thrilled than hitting the elusive “champagne tap,” a perfect lumbar puncture with zero red blood cells.

So, I have committed the next decade to helping fellow doctors understand and navigate the intricate tax rules, one rule at a time, while also assisting them in lowering their tax bills—so they can finally take that well-deserved vacation in Hawaii (we love Hawaii!).

I hope my blogs reflect my excitement and humor, making the typically dry topic of tax more engaging and enjoyable.

Education and Certifications:

2022 – 2026: Master of Science in Taxation, Bruce F. Braden School of Taxation, Golden Gate University, San Francisco, CA

2022 – 2024: Graduate Certificate in Taxation, Bruce F. Braden School of Taxation, Golden Gate University, San Francisco, CA

2024: Certified Tax Coach, American Institute of Certified Tax Planners (AICTP)

2022: Enrolled Agent (EA), U.S. Department of the Treasury

2016: Fellowship in Palliative and Hospice Medicine, University of California, Irvine

2015: Residency in Emergency Medicine, University of California, Irvine

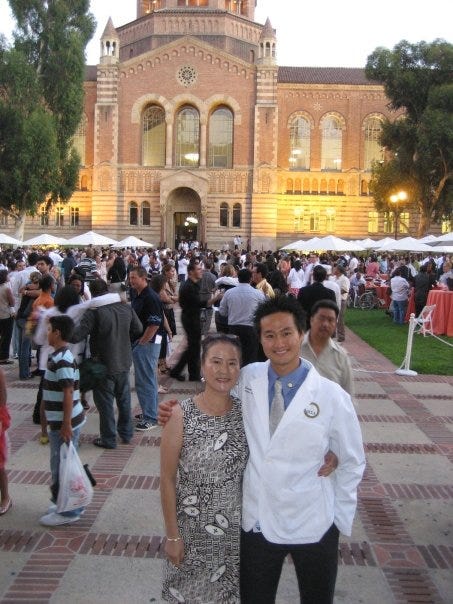

2012: M.D., David Geffen School of Medicine at UCLA

Disclaimer

One of my heroes, Mel Herbert, MD, founder of EM-RAP, may have once said:

“Don’t just do something, stand there.”

That would be my advice to you after reading my blog—stand there (for now) and don’t do anything (yet).

Why?

While I am a tax professional, I am not your tax professional. I do not know your particular situation, and tax matters can be complex. What works for one person may not work for another.

Before taking action, assess your situation and consult with your tax professional to ensure any strategy aligns with your specific circumstances.