$7,000 or $15,000?

The Right Way to Pay Your Kids from Your Business!

“$7,000 or $15,000? That is the question.”

That’s what Dr. Shakespeare asked me the other day—“How much should I pay my kids out of my business?”

I told him, “That’s the wrong question, Dr. Poet!”

A ton of TikTok videos tell you to pay your kid $7,000 so your business can take a $7,000 tax deduction while fully funding your kid’s Roth IRA. Others say to pay them $15,000 so your business gets a $15,000 tax deduction, and your kids don’t owe federal income tax.

While these rationales sound convincing, that’s not the right way to think about hiring your kids and determining how much to pay them.

In this article, I’ll cover three key factors that truly matter when hiring your kids, setting their pay, and understanding the tax implications.

#1. Business Need, Appropriate Tasks, and Reasonable Salary

You must have a legitimate business need to hire an employee. Let’s say you work at multiple hospitals doing locum work. In that case, it would be reasonable to hire an assistant to manage your schedule, submit billing, and track expenses. Instead of hiring someone else, you’re choosing to hire your child—that’s the angle you need to justify.

That brings us to appropriate tasks. Your child must be able to competently perform the assigned business duties. Hiring a 7th grader for basic office work might make sense, but hiring a 7-year-old for complex administrative duties would not be reasonable in the eyes of the IRS.

Now, your child must actually perform a legitimate job that your business needs.

That means:

They must track their tasks on a timesheet.

You can’t just write them a check for existing.

Their pay must be reasonable for the tasks they are performing—no paying your 7-year-old $15,000 to be a schedule manager.

Consider using Salary.com to determine an appropriate wage for the work they perform.

Tax Court Case: What Not To Do:

A physician once paid his children for answering phones and performing secretarial work. The Tax Court denied the deduction because:

The children had no specific work hours.

The tasks were likely routine chores rather than necessary business services.

They were paid a flat amount (e.g., $7,000 upfront at the beginning of the year).

There was no bona fide employer-employee relationship.

Case Reference: Furmanski, Anthony R., (1974), TC Memo 1974-47.

Key Takeaways

Document the tasks your child performs.

Determine a legitimate hourly wage for the role.

Have them track their work hours.

Pay them like any other employee—electronically or via checks (no lump sums or undocumented cash payments).

#2. Legal Requirements

“How old do my kids have to be to hire them?”

That’s another common question. The answer depends on federal and state child labor laws.

Under federal law (FLSA), the minimum age for most non-agricultural work is 14, with restrictions on work hours for minors. However, the FLSA exempts children employed in a parent’s solely owned business, as long as the work is non-manufacturing and non-hazardous. So, business tasks such as managing schedules or shredding paper should generally be acceptable under federal law.

Tax Court Case: What To Do

In Eller v. Commissioner, the Tax Court upheld that taxpayer parents hired their 7, 11, and 12-year-olds for their mobile home park business, paid them reasonable compensation, and took a business deduction.

The IRS initially disallowed the deductions, but the tax court ruled:

We have “concluded from our examination of the record that most of the compensation paid was both reasonable in amount and based on services actually rendered.”

The Tax Court sided with the taxpayers and allowed the business deduction for hiring their 7, 11, and 12-year-olds.

Case Reference: Eller v. Comm’r, 77 T.C. 934.

Key Takeaway

Pay your child a reasonable amount for the work they are capable of performing and actually do.

For state laws, requirements vary, so it’s important to check local labor laws to ensure your child can legally perform the work. Some states do not allow a 12-year-old to work in any business, even if owned by a parent, or may require a work permit.

#3. Tax Compliance Requirements

Hiring your child comes with tax compliance responsibilities.

Treat them like any other employee (except for a few tax exceptions).

Payroll & W-2 Requirements:

If you pay your child more than $600, you must issue a W-2 at year-end. Have them complete a Form W-4, Employee Withholding Certificate

Some IRA providers (e.g., Merrill Lynch) may require a W-2 to open an ROTH IRA for them.

Payroll Tax Exemptions:

If you operate as a sole proprietorship, an LLC taxed as a disregarded entity, or a partnership where the only partners are you and your spouse, then:

No FICA taxes (Social Security & Medicare) if your child is under 18.

No FUTA (federal unemployment tax) if your child is under 21. Therefore, Form 940 (annual FUTA return) is not required.

However, if your business is an S Corporation, C Corporation, or a partnership with non-parent partners, your child’s wages are subject to FICA and FUTA because those entities do not qualify for the child employee tax exception.

Family Management Company Alert:

If someone online recommends forming a “Family Management Company” to avoid FICA/FUTA when your business entity is an S Corporation or C Corporation, it’s best to avoid it!

This strategy is unlikely to hold up with the IRS due to a lack of economic substance in forming a family management company.

Employer Tax Responsibilities:

Withholding Federal Income Tax – Even if your child doesn’t owe federal income tax, you should withhold and report their wages via Form 941. However, if your child had no federal income tax liability last year and expects none this year, no withholding is required, as long as their W-4 reflects exempt status.

State Payroll Taxes – State rules vary. Even if no federal FUTA tax is due, some states still require state unemployment insurance payments.

Business Bank Account – Pay your child from your business account, not in cash, to ensure proper documentation for business deductions.

4. Taxation Considerations (Bonus Section)

In most cases, paying your child up to $15,000 (the standard deduction for a single filer in 2025) will result in zero federal income tax.

However, this isn’t always true—especially if your child has investment income.

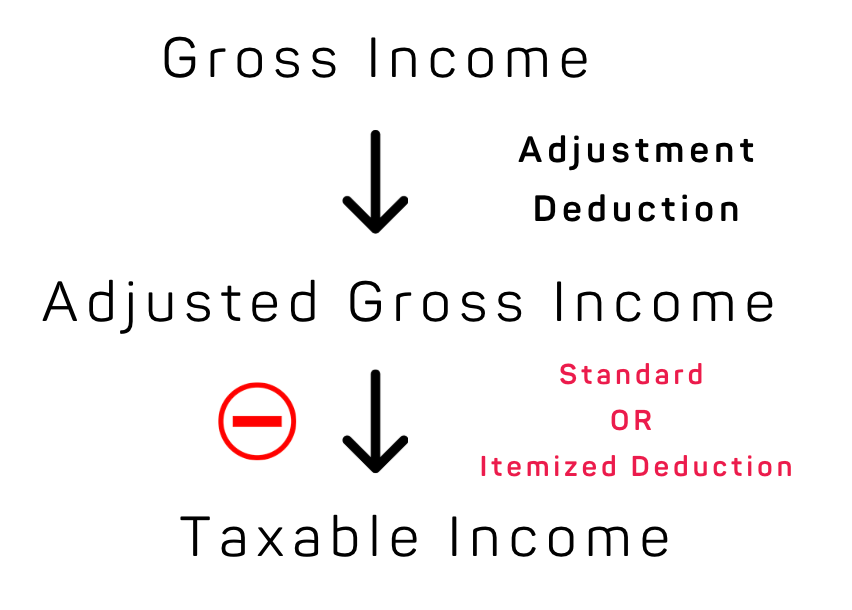

The answer lies in the standard deduction for dependents!

For adults, the standard deduction is a fixed amount based on their filing status (e.g., $15,000 for single filers in 2025).

For dependents, the standard deduction is dynamic, based on how much they earn:

In 2025, the standard deduction for dependent is the greater of $1,350 or ($450 + earned income), capped at $15,000.

Scenario 1: No Investment Income

Kid earns $10,000 working for your business (considered earned income), making their gross income $10,000.

Standard deduction = $10,450 ($450 + $10,000).

No taxable income.

Scenario 2: Has Dividend Income

Kid earns $10,000 working for your business + $1,500 in dividends (unearned income), making their gross income $11,500.

Standard deduction remains $10,450.

Taxable income = $1,050

So, even if the child’s total income is less than $15,000, they can have a federal income tax liability because the unearned income is not fully offset by the standard deduction.

State Tax Considerations

For state taxes, the standard deduction varies (e.g., $5,540 for single filers in California). Your child may owe state income tax even if they owe zero federal income tax.

Final Thoughts

Dr. Shakespeare asked me the wrong question—it’s not about $7,000 or $15,000.

It’s about:

your business needs.

a reasonable wage for the work they do.

ensuring they are capable and old enough to perform those tasks.

Hiring your child can teach them the value of hard work, and paying them a salary at an early age can jump-start their future savings through one of the most powerful savings strategies—the Roth IRA.

Understanding tax implications comes last—because the first three requirements must be met to legitimately hire your child and take business deductions.

Disclaimer: click here