Cash Balance Plans Are Hot Among Doctors... But Not Without Risks

Three traps to watch out for before jumping in

Cash Balance Plans are hot 🔥 - especially for high-income, non-W-2 physicians (yes, you, Dr. S. Stanford!).

They’re IRS-approved tax shelters that can let you stash six figures of pre-tax money every year - potentially more than $1m in just 5-7 years.

Nice!

But before you start too excited about snubbing Uncle Sam (for now), know this: it comes with strings. Big ones.

Cash Balance Plans are a type of defined benefit plan, which means they’re governed by a strict and complicated set of federal employment rules.

The rulebook? It’s called ERISA. (And no, ERISA is not the newest member of BLACKPINK.)

She’s the federal law that says:

“If you start a Cash Balance Plan, you better commit, you better go slow, and you better pay.”

Here are three common traps to watch for before entering a long-term (at least 5-7 year) relationship with ERISA.

Trap #1: Once You Pop, You Can’t Stop

(It’s like Pringles—but with IRS penalties)

Starting a Cash Balance Plan is a serious commitment.

Once it’s in place, your business is generally required to fund it each year — regardless of what’s happening in its bank account (Yes, there are exceptions. But don’t count on them casually.)

Even if your wife wants to a romantic getaway to Bora Bora, you still have to make the minimum required contribution. That amount is calculated by your actuary based on salary, account balance, and the plan’s expected growth.

Fall short, and you could owe a minimum of 10% excise tax on the unpaid minimum (and no, you can’t blame your wife for it).

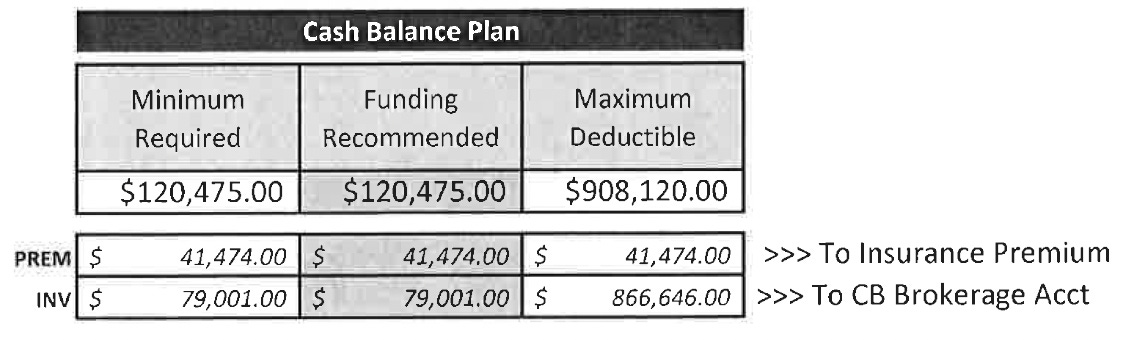

For example, if your required minimum contribution is $120,000 (like in the example below) and you contribute nothing, the penalty alone could be $12,000—which might be just enough for two iPhones made in the U.S. LOL

Citation: IRC §430 for minimum contribution; IRC §4971 for excise tax

Trap #2: Great Investment Returns Can Kill Future Deductions

This one sounds backward, but it’s true.

If you go full Bitcoin-Maxi and dump all of your Cash Balance Plan in a Bitcoin ETF -during a bull run — and triple your account balance in 6 months— guess what happens?

Your future contributions (and the juicy tax deductions that come with them) might get slashed!

Why?

Because your cash balance balance isn’t designed to 10x like BTC in a matter of months. It’s supposed to grow slow and steady, like a tree, not a moonshot.

If the present value of your plan account gets too close to the IRS limit (about $3.5M in today’s dollars under IRC §415) too early, you might be locked out of making additional contributions until you’re closer to retirement.

So if your plan skyrockets in year 4 due to your BTC investment, and you were planning to contribute steadily for 10 years per ERISA’s rules, your may end up benched for the remaining 6 years - completely defeating the point of using the plan as a long-term tax shelter.

Trap #3: Expensive to Set Up and Maintain

Cash Balance Plans are tax beasts—but they don’t come cheap.

Startup cost: $2,000–$3,000

Annual maintenance: $2,000–$4,000

Why so pricey?

Because there’s a mountain of compliance work involved.

Actuary: Calculates your minimum and maximum allowable contributions annually based on age, salary, and account balance.

TPA (Third Party Administrator): Prepares plan documentations and Form 5500 with Schedule SB, runs nondiscrimination tests, tracks vesting, and make sure that plan stays ERISA-compliant.

PBGC insurance: If your plan covers 25 or more employees, you may owe annual insurance premiums to the Pension Benefit Guaranty Corporation—kind of like FDIC, but for pensions. If your company goes belly-up, PBGC might cover a portion of the promised benefits.

Final Thoughts

Cash Balance Plans can be a hot and attractive tax shelter for non-W2 physicians with consistently high income —but you need to know what you’re signing up for when you get involved with ERISA.

Once you “date” ERISA, you’re in a committed relationship with Ms. Federal Law and she expects

Commitment (you must fund it)

Patience (no YOLO investing - forget being a BTC Maxi).

Big annual maintenance fees (setup and ongoing admin costs)

She’s protective, sure.

But if you don’t follow her rules, she’ll make your life a nightmare.

So think it through.

Cash Balance Plans are hot—but only if you’re ready to play by ERISA’s rule.

She’ll give you deductions - but she’ll make you earn them.

Disclaimer: click here