Doctors with a newborn in 2025: Don’t miss this "free" $1,000

One election can be worth four figures.

Got a new baby in 2025? Congrats (hope you are getting some sleep)!

There may be a “free” $1,000 waiting for your newborn - but only if you take an action!

There is a new federal pilot program, where, if you open a Trump Account, the U.S. Treasury funds a one-time $1,000 starter deposit for your baby.

What is the Trump Accounts Pilot Program?

The OB3 created a new type of account, officially called a “Trump Account,” and it also established a $1,000 contribution pilot program under IRC §6434.

This program is real and codified in the Internal Revenue Code.

The key is simple: the government contribution is not automatic. You have to make the election/request.

Who is Eligible for the $1,000 Government Deposit?

Based on IRS guidance and the statute, the $1,000 pilot contribution generally applies if your baby:

was born from January 1, 2025 through December 31, 2028

is a U.S. citizen

has a valid Social Security Number

has not already had a pilot-program election made for them.

How to Claim the “Free” Money

This is the part people miss.

The government doesn’t automatically open the account and drop the $1,000 in your child’s name just because you had a baby. You have to elect/request it.

What you file

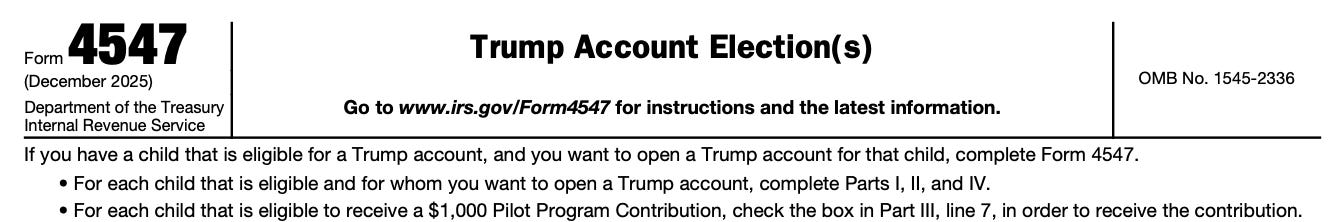

IRS Form 4547 (Trump Account Elections(s)) is the form used to establish an initial Trump Account and request the $1,000 pilot contribution. An authorized individual (e.g., parent) completes it and includes the baby’s SSN.

When you file it

Form 4547 can be filed electronically with your federal tax return for the year the election is made. The IRS expects an online election option to be available beginning mid-2026.

What happens next

Once processed, the Treasury pilot contribution is paid into your baby’s Trump Account. But the IRS guidance indicates contributions will be deposited into the Trump Account no earlier than July 4, 2026.

Practical timing note (so you don’t get surprised)

Guidance indicates account registration and funding infrastructure roll out in 2026, with July 4, 2026 referenced as the earliest date contributions can begin. After filing the election, you’ll receive instructions to complete account setup and authentication through the program’s portal.

Why This matters (Even Though it’s “only” $1,000)

The real power isn’t the $1,000. It’s time.

Trump Accounts are designed for long-term, tax-deferral compounding. During the “growth period” (before age 18), investments are limited by law to low-fee, broad US equity index funds. Withdrawals are generally not allowed. The idea is to give the money a long runway to compound before adulthood.

Conclusion

If your child was born in 2025 (or will be born through 2028), don’t assume the government deposit just “shows up.” It won’t. The program is build around an election.

So here’s the simple takeaway: when you file, make sure Form 4547 is on the checklist for your newborn. That one step is what turns “I heard there’s free money available for my baby” into “we actually claimed it”.

And if you want to be the parent who doesn’t miss easy wins, this is one of those moments.