Golden Shackles: The Truth About "Too Good to Leave" Pension

What Physicians Need to Know About Pension Risk

Some medical groups offer such jaw-dropping pensions that employee physicians call them “golden shackles”. Even if they want to leave, the incentive to stay is so strong that they feel trapped.

I used to work for one of those medical groups - a large, well-known medical organization with an industry-leading pension plan.

The deal? If you worked full-time for 30 years, you’d receive 50% of your final salary—for life.

Sounds amazing, right?

More than a few of my physician colleagues wanted to quit, but stayed for the pension.

“Just a few more years,” they’d say, clinging to the dream of spending their golden years sipping piña colada on Wakiki Beach.

But here’s the thing: the world is unstable. Companies go under. Hospitals merge. Health systems vanish.

So one day, I asked a retirement specialist a simple question:

“What happens if my medical group goes belly up before I retire?”

The answer? Way too optimistic:

“You’ll be fine. The pension is covered.”

Well, after spending a ton of time digging into how pensions actually work, here’s what I’ve learned—something that might surprise you:

Your pension payment is not as “covered” as you think.

What You Should Know About Pensions

A pension is a promise.

Your employer is basically saying, “Trust me. We’ll pay you when you retire.”

That’s very different from a 401(k).

A 401(k) is yours. It’s an actual account with your name on it. You can log in, see the balance, adjust your investments, roll it over, and yes—it’s legally your money. You’re entitled to whatever’s in that account, no matter what happens to your employer.

But a pension?

There’s no individual account with your name on it. Your benefit comes from a big, shared pot of money managed by the employer.

If your company runs out of money and goes belly up? You’re just another creditor in line.

And creditors? They don’t always get paid.

Isn’t There Pension Insurance?

Yes, there is.

It’s called the Pension Benefit Guaranty Corporation (PBGC), kind of like the FDIC insurance for pensions.

If your medical group fails and the pension plan is underfunded, PBGC steps in and pays something.

But—and this is a big but—PBGC coverage has limits.

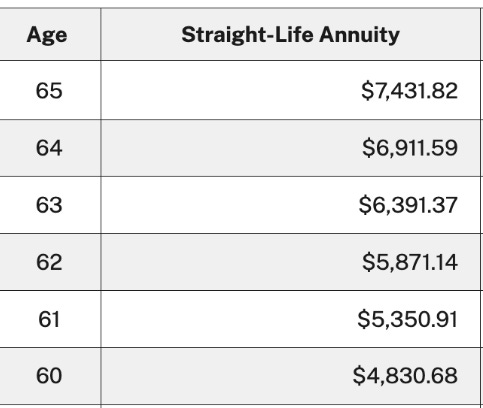

It doesn’t guarantee your full pension. While the IRS allows pensions to pay up to $280,000/year as a single life annuity (2025 limit), PBGC caps the amount they’ll actually guarantee based on your age. And they only cover what you’ve earned by the time the plan terminates. No projected benefits. No extra promises.

A Real-World Example:

Let’s say you’re a 65-year-old plastic surgeon making $700k. You’ve worked for your group for 30 years and haven’t started your pension.

If your group goes bankrupt tomorrow, the most PBGC will pay you is $7431.82/month - that’s about $89,182/years, or just ~ 32% of what you’d expect under the IRS pension limit.

That’s a pension liposuction no one asked for!

And those “extra pension-like perks” your company may have promised - like supplemental or excess benefits?

Gone.

Gone with the wind.

That $7431/month is all you’ll ever get. No cost-of-living adjustments. No inflation protection. Even if a carton of eggs hit $100, PBGC doesn’t care.

Another Gut Punch - For Younger Doctors

The system is even worse for younger physicians who committed early to their employer.

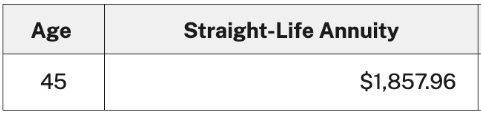

Let’s say that same plastic surgeon had joined at age 30, worked 15 years, was already on track to receive an $8k/month pension. If the group went bankrupt when he was 45, the PBGC limit for his age would cap his guaranteed benefit at just $1857.96/month.

Now here’s the kicker:

His colleague, also 45 years old, who joined only 5 years ago - and had earned, say, $2,000/month pension - would also receive the exact same payout: $1857.96/month.

Same payout. Vastly different commitment.

If you’re young and banking on a pension you’ve “earned”, a company failure could hit far harder than you think.

The Tax Twist

If you lose part of your pension due to your employer’s bankruptcy, you don’t get to claim it as a tax deduction.

Why not?

Because technically, it was never your money in the first place. The pension wasn’t an account you owned. It was just a promise made by your employer.

So when that promise vanishes, the IRS doesn’t consider it a “loss.”

No tax write-off. No deduction. No consolation prize.

Final Thoughts: Are Golden Shackles Worth It?

So here’s the truth:

Yes, pensions are insured—but only up to a point.

The younger you are, the less PBGC is likely to protect if your employer goes under.

And If your job is draining your soul and you’re only staying for the pension, ask yourself:

Is it really worth spending your best years chasing a promise that might vanish?

You only live once.

Bad things happen - often without warning.

(Trust me, I’ve seen it firsthand, over and over, as a palliative care physician)

So make sure you’re not trading your freedom and happiness for a benefit that could disappear through no fault of your own.

Disclaimer: click here