How I Almost Cost My Family $$$ with One "Wrong" Checkbox

Choosing the wrong home title can erase your step-up in basis and leave your family with a massive tax bill.

Ever heard the saying, "The best way to learn is from someone else’s mistake?”

Well, today you get to learn from mine. And it could save you a six-figure tax bill.

Years ago, my wife and I bought our first property.

We knew nothing about home ownership, including how we should hold the title.

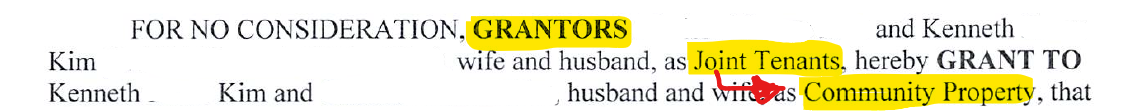

The options were

Joint Tenancy

Community Property

We chose Joint Tenancy - a decision that, in a worse-case scenario, could have cost us a fortune in taxes.

Turns out, in California, the “right” answer is almost always Community Property. And trust me, you don’t want to screw up like I did.

This isn’t just a California thing either. This same rules may apply in other community property state: Arizona, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin.

So, what’s the big deal?

Let’s uncover the hidden tax superpower of community Property

Community Property: Your Hidden “Tax” Superpower

In California, if you buy a home with your spouse using “community funds” (think wages or business income earned during your marriage), that property is considered community property. T

That means:

You each own 50% of the property

But both of you have unlimited rights to use 100% of it.

The superhero perk comes from the “step-up in basis”

Under Internal Revenue Code §1014(b)(6), when one spouse dies, the entire property gets a step-up in basis to its current market value.

Translation: the surviving spouse can sell the property immediately after their partner’s death with no capital gains tax.

Sounds too gloomy? Let me lighten it up with a famous stock.

NVIDIA example: A $1 Million Gain Erased

Imagine this: you and your spouse bought NVIDIA stock back in 1999 for $38/share. Today, it’s worth a cool $1m.

Scenario 1: Sell While Both Alive

Stock basis: $38

Sale price: $1M

Taxable gain: ~$1M

Tax Bill: ~ $200k at 20% capital gains rate

Ouch!

Scenario 2: One Spouse Dies (stock = Community Property)

Stock basis resets (steps up) to $1M

Sale price: $1M

Taxable gain: $0. Voilà!

Scenario 3: One Spouse Passes Away (stock = Joint Tenancy)

Only half steps up

New basis: $500,019 ($19 original basis for the surviving spouse + $500k for the deceased spouse’s stepped-up half)

Sale price: $1M

Gain: $499,911 ($1m sale price - $500,019 basis)

Tax Bill: ~ $100k at 20% capital gains tax

That’s the difference between no tax and a six-figure tax bill.

How I Screwed Up (And Fixed It)

When my wife and I bought our first property, I blindly checked Joint Tenancy on the title form - because that’s what someone told me to do.

Big mistake.

If I had died, only my half of the property would have received a step-up in basis. The other half would have stayed at its original price.

That means, if my wife sold the house, she’d be on the hook for a massive capital gains tax bill - all because of one checkbox.

Real Estate Example: $3.1M Home

Imagine you bought a house for $100,000 in Santa Clara next to NVIDIA’s HQ in 1999. Today, let’s assume that property is worth $3.1M.

If the title is held as Joint Tenancy:

One spouse dies → Only half of the home gets the step-up in basis

New basis = $1,555.000 ($1.5M stepped-up half + $50k original half)

Sales price: $3.1M

Gain: $1,550,000.

After $500k primary home gain exclusion → $1,050,000 taxable gain

Tax bill: =~ $200k tat 20% capital gains rate.

If, instead, the title had been community property:

Entire $3.1M steps up.

Sale price: $3.1M.

Basis: $3.1M

Gain: $0.

Tax bill: $0

That’s the difference between a $200k tax bill and zero tax.

How I Reversed My Screw-Up

Once I realized my blunder, I filed a grant deed with the county to change our title from Joint Tenancy to Community Property.

Now, if I pass away, my wife gets the full step-up in basis. She can sell with no tax bill.

It’s like a “tax” life care planning - something I enjoy both as a tax pro and a palliative care doc. :)

Final Thought

If you live in a community property state, check the title to your home.

If it’s not Community Property (or Community Property with Right of Survivorship), talk to your attorney. There may be legal or non-tax reasons to hold it differently, but from a purely tax perspective, Community Property is the clear winner.

Don’t let a simple checkbox on a form cost your family a fortune.

Learn from my mistake - not your own!