How the IRS Paid for My Gangnam Style Business Trip to South Korea

The two rules you must know to maximize your next foreign travel deductions

Thinking about making your next vacation a business trip?

I just wrapped up an amazing 10-day trip to South Korea — ate some of the best Galbi, spotted tons of tourists wrapped in headgear like post-op bandages from Gangnam’s famous plastic surgeries, and took a ridiculous number of selfies throwing up the classic a V-sign. LOL.

But here’s the best part: my tax business covered 100% of my airfare and transportation, 100% of my hotel, and 50% of my meals.

Let me walk you through how I got the IRS to help fund my trip to Seoul.

The Rules Are Different for Foreign Business Travel

When it comes to international business trips, the IRS has a slightly different playbook than it does for domestic travel—especially when it comes to deducting airfare and transportation (like Uber rides to and from the airport).

There are two key rules you’ll want to master if you’re hoping to maximize your trip deductions.

Rule #1: The Primary Purpose Has to Be Business

To deduct your full transportation costs to a foreign country, the main purpose of your trip has to be business.

In my case, I was invited to attend a tax conference in Korea focused on U.S. international taxation. That was the primary reason for the trip (believe it or not, the galbi was just a side dish. 😉).

Here’s how I backed it up:

I saved all the emails and communication about the conference invite.

I held onto the official agenda and conference materials.

And—this part’s important—I didn’t book my flight or hotel until I had written confirmation of the conference. That timing helped show the trip wasn’t primarily a vacation in disguise.

Pro tip: The IRS cares about your intent. Your documentation should clearly show that the trip was planned around business first, with any personal activities added on afterward.

And remember, the more you document—conferences, meetings, work sessions—the easier it is to show this wasn’t just a cleverly disguised vacation.

Rule #2: The 7-Day Rule

A: Trips lasting 7 days or fewer

If your trip is 7 days or fewer (not counting the day you leave the U.S), and the primary purpose is business, then you can deduct 100% of your transportation costs —even if you squeeze in a little sightseeing.

For example: let’s say you fly out to give a keynote at a conference, then stay six more days to explore the city and make some business connections. As long as the whole trip is 7 days or fewer, and business was the main reason you went, you can still deduct 100% of transportation expenses, including airfare and Uber rides.

Now, compare that to a domestic trip: for U.S. travel, you can only deduct airfare if more than 50% of the days are business days.

So, what actually counts as a business day?

Getting this part right is key if you want to maximize your deductions.

Business Days include:

Travel Days: The days you’re flying to or from your business destination.

Conference Days: If you attend a conference for more than four hours and it’s related to your business, that counts.

Meeting Days: Pre-scheduled meetings with clients or business partners that last at least four hours also count.

Sandwiched Weekends: If you have business on both Friday and the following Monday, then the weekend in between—Saturday and Sunday— counts too.

Now, what doesn’t count?

Personal Days, which include:

Days with no meaningful business activity—even if you checked your email.

Days spent sightseeing, relaxing, or doing purely personal things.

B: Trips lasting more than 7 days

Here’s where it gets a little stricter - and trickier.

If your foreign trip lasts more than 7 days, you can only deduct 100% of your transportation costs if less than 25% of the days are personal.

In my case, I was in Korea for 10 days. That meant I was only allowed 2 personal days max in order to fully deduct my transportation expenses. If I had squeezed in just one more personal day, I would have hit 3 personal days - crossing that 25% threshold - and only 70% of my transportation costs would have been deductible.

Knowing this rule, I planned carefully:

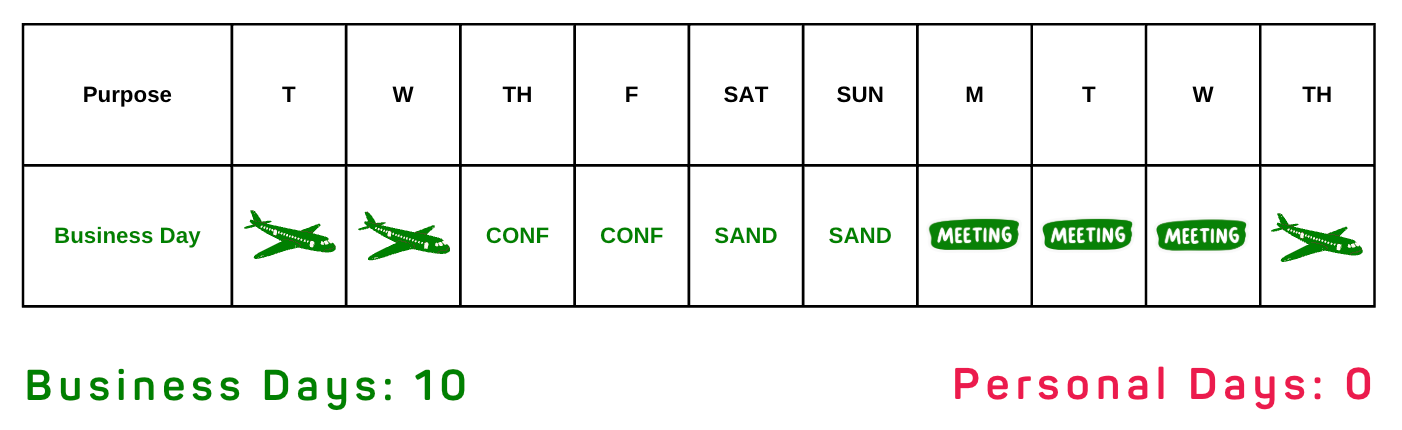

Tuesday & Wednesday: Travel days to Korea => business days

Thursday & Friday: Attended the international tax conference

Saturday & Sunday: Weekend days sandwiched between business days => business days

Monday to Wednesday: Scheduled 4+ hour business meetings with colleagues each day

Thursday: Flew home => travel day => business day

Even though I spent my evenings shopping in Myeong-dong and feasting in Dongdaemun, every single day on the calendar counted as a business day.

Pro tip: The IRS only cares about what you’re doing during business hours (roughly 8a-5p). Your late-night street adventures? Totally fine. Just make sure your daytime schedule is airtight with legitimate business activities.

Bonus Rule: Meals and Lodging (a.k.a. "Survival Expenses") Deduction

Whether you're traveling domestically or internationally, you can only deduct lodging and meals on business days.

Knowing this, I designed my itinerary so that every single day counted as a business day - which meant I could maximize my survival expenses deductions, including my nightly Galbi festival in Myeong-Dong. :)

As a result, I was able to deduct:

100% of my hotel costs (recommend ENA Hotel in Namdaemun), and

50% of my meals (which is generally the max allowed under the IRS rules).

Simple planning + solid documentation = thousands saved!

Final Thoughts

If you want the IRS to help pay for your international business travel - and have your own little immersion in Gangnam style, you’ve got to plan ahead and document everything.

Let’s recap:

Keep the trip 7 days or fewer if you want an easier route to deduct 100% of airfare and transportation costs.

If your trip is longer than 7 days, make sure personal days are less than 25% of the total - otherwise, your transportation deduction gets reduced.

Lodging and meals are only deductible on business days - so plan wisely to maximize those business days.

And above all, document your business intent before you book anything.

The IRS won’t just take your word for it—so make sure your calendar, emails, and itinerary tell a crystal-clear story.

Now go enjoy that Galbi—with a tax deduction on the side.

Sources:

IRS Publication 463, Travel, Gift, and Car Expenses

Internal Revenue Code §274(c)

Disclaimer: click here