Married Doctors With Rental Properties: Be Aware

The expensive, headache-inducing tax consequences of transferring a rental property into an LLC

Got a rental property you own as a married couple?

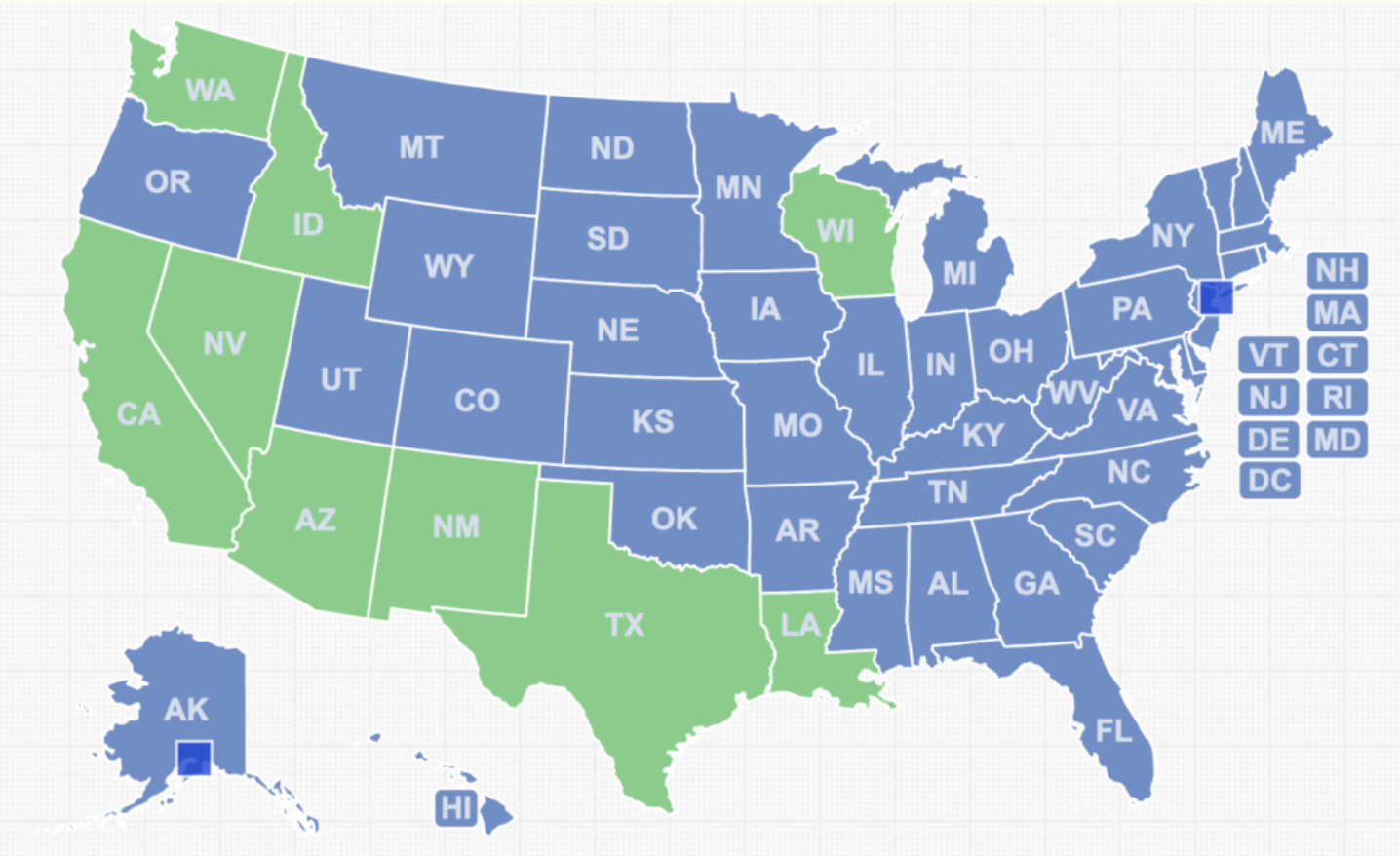

Do you live in a separate property state (most Midwest and East Coast states)?And are you thinking about transferring that rental into an LLC?

Think again.

There may be unintended tax consequences.

Unintended Consequences

If you and your spouse own a rental property through an LLC and live in a separate property state, the IRS generally treats that LLC as a partnership.

That means:

You must file a partnership tax return (Form 1065)

You must issue a Schedule K-1 to each spouse

You no longer report the rental directly on Schedule E

Same property. Very different tax compliance

What Does That Mean in Practice?

More cost.

More complexity.

More headaches.

#1: Form 1065 preparation:

Partnership returns are complicated and require substantial work. Preparation fees are commonly $1,500 or more every year, even for a single rental property.

This is not a one-time cost. It repeats annually.

#2: Additional state filings

Many states require a separate partnership return. Some also impose minimum taxes or annual LLC fees.

These costs apply even if the rental barely breaks even or shows a loss.

#3: Basis and capital account tracking

This is where most owners get lost.

As a partner, you are responsible for tracking your tax basis and capital account. These numbers affect:

Whether losses are deductible

How distributions are taxed

Gain or loss when you sell

Most owners end up hiring a professional to track this, which means more fees and more back-and-forth.

#4: Bookkeeping and accounting costs

Partnerships often require monthly or quarterly bookkeeping to properly support allocations, depreciation, and partner activity.

What used to be a simple Schedule E now looks more like a small business.

#5: Depreciation and allocation complexity

Depreciation must be allocated between partners correctly.

Errors can create mismatches between capital accounts and K-1s. Fixing these mistakes later can be expensive and painful.

Now Compare that to Community Property States like California.

In community property states, a married couple who jointly owns a rental through an LLC can elect to treat the LLC as a disregarded entity for federal tax purposes.

The result?

No partnership return

No K-1s

Rental activity reported directly on Schedule E

Same property.

Same rental income.

Very different tax filing burden.

This might be one of the few tax advantages of living in California.

The Tax Pearl:

Before transferring a rental property into an LLC, understand the tax consequences first.

The legal structure may look the same on paper, but the tax compliance can be dramatically different depending on where you live.

This is one of those decisions that is easy to do legally, but expensive to undo on the tax side.

Especially when you are already overwhelmed with patients, work, and life, this is not the kind of avoidable headache you want to inherit.

Disclaimer: click here