"One Big Beautiful Bill" Tax Reform Update for Doctors - Part 3

Estate tax just got a booster shot — what every doctor needs to know to protect their legacy.

Whether you cheering or cursing it, one thing’s for sure - the “One Big Beautiful Bill” (OBBB) is packed with provisions that tilt the scales in favor of the wealthy.

And one of the biggest windfalls?

A massive boost to the gift and estate tax exemption.

If you’ve spent decades building a successful practice, growing your investments, and planning your legacy, this is one rule you’ll want to understand - because it could mean millions more for your heirs instead of the IRS.

The Big Boost: Estate and Gift Tax Exemption

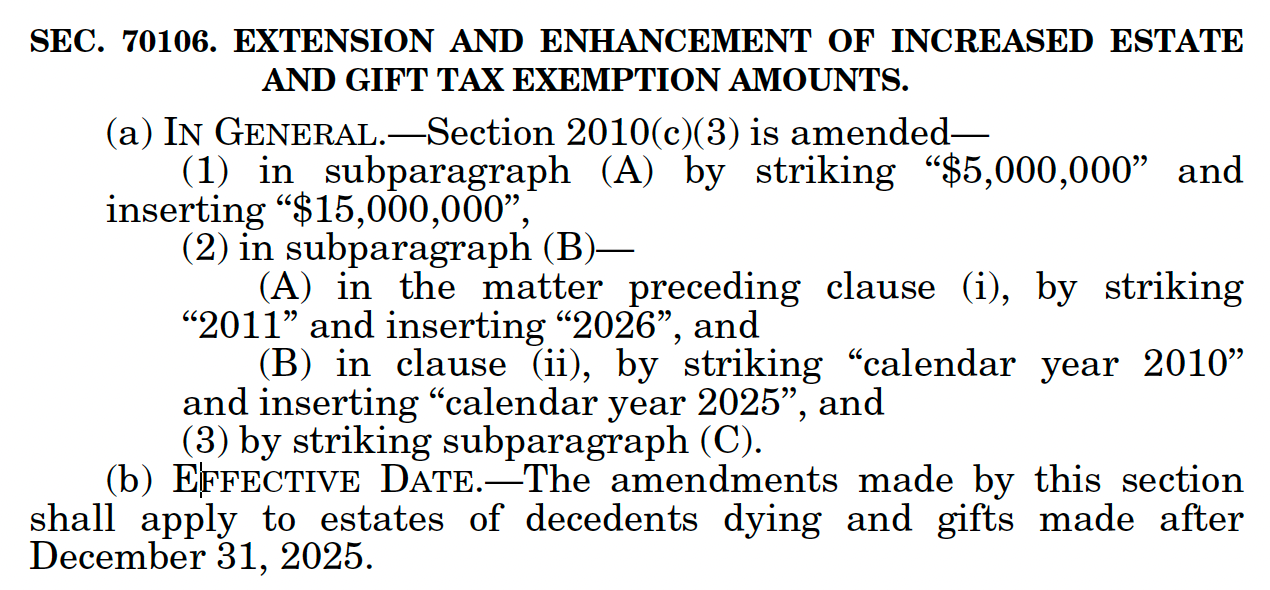

Before the 2017 Tax Cuts and Jobs Act (TCJA), individuals could pass on up to $5 million (inflation-adjusted) during life and at death - estate tax free. TCJA doubled that to $10 million, which, after inflation, lands $13.99 million per person in 2025.

But starting in 2026, OBBB raises the bar even higher:

$15 million per person can be transferred tax-free - during life, at death, or some combo of both - assuming you haven’t already used up your exemption.

Why This Matters: The IRS Doesn’t Play

Estate tax is no joke. Once you go over the exemption amount, the federal estate tax rate rockets up to 40% - fast.

Let’s break that down:

You’re single with $31 million in total assets.

Under OBBB, the first $15 million is estate tax-free.

The next $1m gets hit with a graduated rate (18% to 40%), which adds up to $345,800 in estate tax.

The remaining $15 million? Hits the top 40% rate, meaning your heirs could lose =~ $6.4 million to estate tax.

Ouch.

Now rewind to pre-TCJA era, when the exemption was only $5 million.

Still $31 million in assets.

First $5 million is tax-free.

Next $1 million still gets graduated rates (18% - 40%) .

Remaining $25 million hit with 40% =~ $10.4 million in estate tax.

Double ouch.

But I’m Married – Does That Help?

Yes, big time!

The U.S. tax system allows “portability”, meaning the surviving spouse can inherit any unused estate tax exemption from their deceased partner. That lets married couple potentially shield up to $30 million.

But don’t miss the paperwork!

File Form 706 (estate tax return) within nine months of death - though you can get an automatic six-month extension by filing Form 4768.

Missed it? Rev. Proc. 2022-32 gives you up to 5 years for a late election - but only under certain conditions.

Miss both windows? You could lose millions in tax-free transfer room.

I’ve seen it happen - a $40 million estate lost the chance to double its exemption simply because the deadlines were missed.

That’s an expensive oversight.

International Reality Check: The U.S. Is Generous

Take South Korea - my home country and birthplace of Gangnam Style - as a comparison. The top estate tax rate is 50%, and it kicks in at just $2.3 million. Even worse? There’s no portability between spouses. If your spouse doesn’t use their exemption, it’s lost forever.

By comparison, the U.S feels like a tax haven for generational wealth - if you know how to plan ahead.

What Can Doctors Do Now?

Even if you’re not worth $15-30 million (yet), it’s pays to know the rules- because wealth can build faster than you think (fingers crossed)

The annual gift tax exclusion for 2025 is $18,000 per recipient (adjusted for inflation)

If you give more than that, you don’t owe tax right away - you are just using part of your lifetime estate and gift exemption.

Example:

Your parents gift you $218,000 to help with a home down payment.

They’ll file a gift tax return (Form 709) to report the $200,000 of taxable gift ($218,000 - $18,000).

But no tax is due - as long as they haven’t exhausted their lifetime exemption.

Bonus tip:

The person receiving the gift owes nothing. Zero.

Final Thoughts

Whether you’re giving or receiving, understanding how gift and estate taxes work is essential to protecting your legacy.

Thanks to the OBBB, you can pass more of what you’ve built to your heirs - without handing a massive chunk to the IRS.

And for doctors - who often accumulate significant wealth over time - proactive planning isn’t just smart, it’s essential.

You trained for years to take care of others. Now it’s time to care for your legacy.

Because if you don’t plan ahead, the IRS just might become your biggest beneficiary.

Need a rockstar estate planning attorney?

Check out Klaus Gottlieb, MD, PhD, MS, MBA, JD, ESQ, LLM (Tax, pending) - a one-of-a-kind physician-attorney who gets both sides of the table. You likely won’t find anyone like him.

Disclaimer: click here