One Big Beautiful Break for Doctors: OBBB Update - Part 4

How The New QBI Deduction Rules Could Save Your Thousands

If your 1099 income is around $500k, the new tax law might finally work in your favor!

Thanks to changes made by the OBBB, the Qualified Business Income (QBI) Deduction just got a facelift.

If you’re earning around $500k in 1099 income, you might now qualify for a $30,000+ deduction that was completely out of reach before.

In this post, I’ll break down what changed, explain what QBI actually is, and - here’s the kicker - even if your income is too high to qualify, there are tax planning moves that can help you unlock the full 20% deduction.

Let’s dive in.

Quick Summary: What Just Changed.

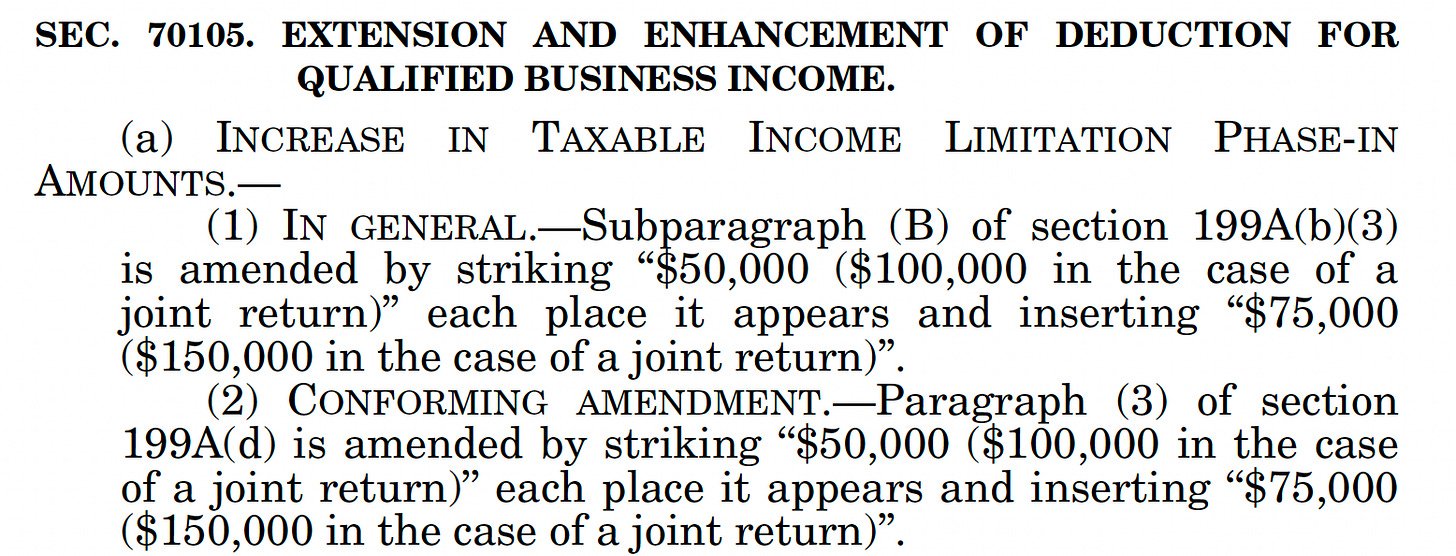

Section 70105 of the OBBB brings four key updates to the QBI deduction.

Permanent status:

The 20% QBI deduction for pass-through business income is now permanent.

Wider Phase-Out Range:

The income phase-out range for high earners expands from $100,000 to $150,000 for joint filers (and from $50,000 to $75,000 for others). Translation? More high earners may qualify for at least some deduction.

$400 Minimum Deduction:

A new $400 deduction is available to taxpayers with at least $1000 in QBI from an active business. (Not a game-changer for high earners, so we won’t focus on this).

Effective Date:

These changes take effect starting in 2026 (for tax years beginning after December 31, 2025)

What Is the QBI Deduction - Why Was It Created?

The QBI deduction, also known as Section 199A, was introduced as part of the 2017 Tax Cuts and Jobs Act (TCJA).

Why?

Because C corporations got a massive tax cut - from 35% down to 21%. Congress needed a way to offer similar tax relief to pass-through businesses like sole proprietorships, partnerships, and S corps.

So they created the QBI deduction, allowing certain self-employed individuals and business owners to deduct up to 20% of their qualified business income on their personal tax return.

Sounds great, right? Well… not so fast.

If you’re a high-income doctor, you’re likely run into some roadblocks. That’s because medical and dental practices are considered Specified Service Trade or Business (SSTB) - a category that gets hit with income phase-outs and limitations once your taxable income starts climbing.

But thanks to the OBBB, those limitations just got a little less painful.

Who Actually Gets the QBI Deduction?

Here’s the sad truth: If you’re W-2-only, you don’t get the QBI deduction.

This deduction is only available for income earned from a qualified trade or business - meaning income from 1099 work (from moonlighting, locums, consulting), running your own clinic, or any self-employed side gig.

So if you're like me and have both W-2 and 1099 income, only the 1099 portion is eligible for the QBI deduction.

The SSTB Penalty: Why High-Income Doctors Gets Screwed

Under TCJA rules, health professionals are classified as being in a “Specified Service Trade or Business” (SSTB) - a designation that brings restrictions.

Once your taxable income hits certain levels, your ability to claim the QBI deduction starts to disappear. Quickly.

For tax year 2025, married joint filers face:

Full 20% QBI Deduction: Taxable income under ~$400,000

Partial Deduction: ~$400,000 and ~$500,000

No Deduction: Over ~$500,000

(For single filers, the thresholds are roughly half that)

Translation?

If you’re a successful doctor earning more than $500k, you get ZERO QBI deduction.

That’s the SSTB penalty in action. Boooooooo!

The Boost from the OBBB: More Doctors Now Qualify

If you’re a married physician with $500,000 of taxable income, you should be dancing.

Under the old rules, $500k meant you were completely phased out of the QBI deduction. Zero. Nada.

But now?

$500k now falls within the expanded phase-out range - so you may now qualify for a partial deduction.

In the best-case scenario, you could see up to $33,330 in QBI deductions, depending on how much you pay in wages or how much qualified property your business owns.

That’s a huge swing in your favor - potentially saving you $12,000+ in federal taxes that you previously couldn’t touch.

Nice!

What If Your Income Is Still Too High?

Then, it’s time to lean into proactive tax planning.

Smart moves can bring your taxable income down into the new phase-out window or even below it - making you eligible for a deduction you previously couldn’t claim.

Here are a few strategies to consider:

Max Out Retirement Plans:

Contributions to a solo 401(k) and cash balance plan reduce your AGI, helping lower taxable income below the QBI limits.

Accelerate Expenses:

Pay for next year’s medical conferences, supplies, or equipment before December 31. Business expenses claimed now reduce this year’s taxable income.

Defer Income:

Delay December invoices until January. If you’re expecting a big capital gain (e.g., from business sales), consider installment sales to spread the income out.

Hire Your Kids:

Pay your children for real work in your business. You shift income from your high bracket into their low (or even zero) bracket - and their wages are deductible to your business.

Make charitable contribution:

Giving reduces taxable income. Even better, under the OBBB, married filers can now deduct upto $2,000 in cash donations “below the line” - even if they don’t itemize.

Bottom line?

These strategies don’t just lower your tax bill —they open the door to deductions you couldn’t claim before.

Final Thoughts

For years, high-earning doctors were shut out of the QBI deduction— left to watch while other business owners enjoyed 20% write-offs.

But starting in 2026, that changes.

The expanded phase-out range means you might finally get a seat at the table.

Translation?

Opportunity is back.

If your taxable income floats near the $500k mark, that is your wake-up call. Start planning now. Find ways to trim your taxable income and qualify for this powerful deduction.

Because when tax reforms tosses you a bone, you don’t just sit there.

You chew on it.

Disclaimer: click here