Tax Reform Update for Doctors #2: Act Now or Lose the $7500 EV Credit!

Smart tax planning tips to help you lock in that $7,500 before it’s gone!

Elon is mad. Real mad.

Why? Because the beloved EV tax credit is going away — real soon.

If you’ve been thinking about buying an electric vehicle, it’s time to stop thinking and start ordering. Right now.

To qualify for the full $7,500 Clean Vehicle Credit (“free money” from the government), your EV must be delivered - not just ordered - by September 30, 2025.

Let me say that again: you must take delivery before September 30, 2025.

Now, let’s break down what this Clean Vehicle Credit is all about - and how smart tax planning could help you qualify.

What is Clean Vehicle Credit?

The Clean Vehicle Credit (aka the EV Credit) is found in Internal Revenue Code §30D, a section that’s been overhauled in recent years (Remember when Tesla lost its credit after selling too many vehicles? That was the old version).

Under today’s rules, claiming the EV credit comes with a few strings attached:

Final assembly must occur in North America

The EV must meet MSRP limits

Battery and critical mineral sourcing rules must be satisfied

You must meet income limits

You can check whether a specific vehicle qualifies by plugging in the VIN at the official government website.

But today, I want to focus on one key requirement that makes or breaks your eligibility: the income limit - because that’s where most doctors will run into trouble, and where the real tax planning opportunities begin.

The Problem: Income Limit for the EV Credit

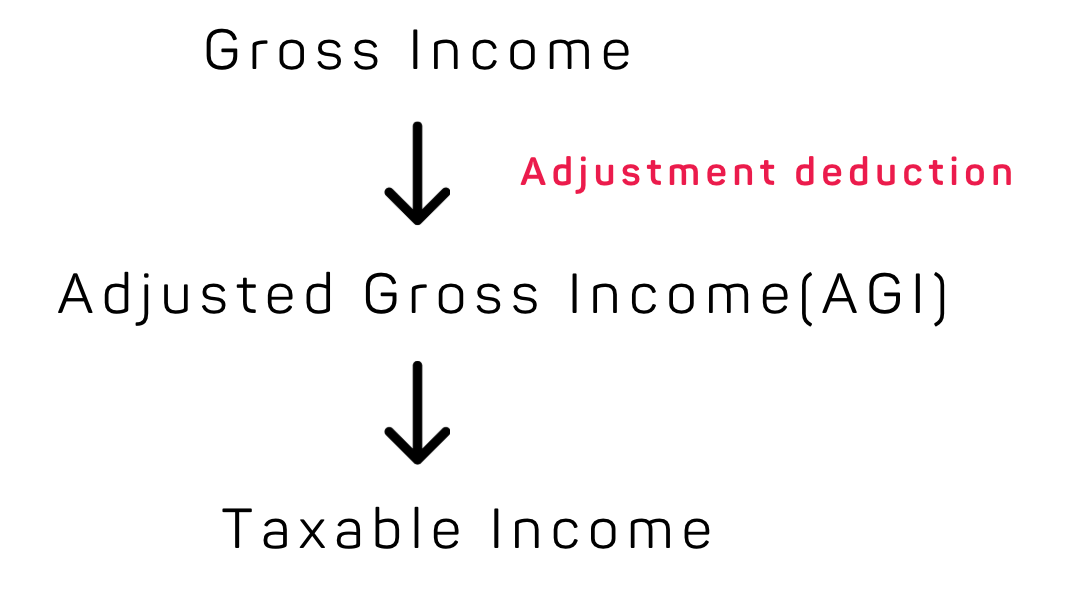

Eligibility for the EV credit is based on your Modified Adjusted Gross Income (MAGI). For 99.9% of you reading this, your MAGI is the same as your Adjusted Gross Income (AGI)— unless you’re excluding things like foreign earned income, which most of you aren’t.

AGI is what you get after subtracting adjustments deductions (aka above-the-line deductions) from your gross income. You’ve seen this in the Individual Tax Formula I’ve talked about before. (check out my video lectures (#1, #2, #3) on that topic if you want a refresher).

Here are the MAGI limits for the EV credit:

Married Filing Jointly: $300,000

Head of Household: $225,000

Single / Other: $150,000

And here’s the kicker: it’s a cliff provision. That means if you’re even $1 over the limit, you get zero credit. Nothing. Nada. That sucks.

So what does that mean for high-income earners - especially doctors?

Tax Planning to the Rescue

If you’re married filing jointly and your MAGI is just above $300,000, you might still have a shot at getting the credit—with the right tax planning.

Remember that AGI comes after applying adjustment deductions (see above) to your gross income. So even if your gross income is $400,000, it’s possible to bring your MAGI down below $300,000 - and qualify for the EV credit.

This is where the magic of tax planning comes into play.

In my previous article, I talked about how wealthy peeps use oil and gas investments to their advantage (if you missed it, I break down the pros and cons there.)

Here’s a real-world example:

Your AGI is $400,000 and you file jointly with your spouse.

You invest $120,000 in a qualified oil and gas deal as a general partner.

That investment gives you an 85% first-year deduction, or $102,000

New AGI: $400,000 - $102,000 = $298,000

Boom. You’re now below the $300,000 threshold, and you qualify for the $7,500 EV credit.

This is the power of understanding the tax rules:

If you understand the rules, you can create the facts to lower your tax.

Final Thoughts

Like Elon, I’m a little mad too.

The window to claim this beautiful tax credit is closing fast.

Elon knows it - and now you do too.

If you’re thinking about buying an EV, don’t wait. Start the order process now so your car is delivered before September 30, 2025.

And if your income is too high to qualify? Don’t assume you’re out of luck. With intentional, strategic tax planning, you can engineer your AGI to fall under the threshold and unlock the $7,500 credit - which is essentially free money from the government.

That’s the power of proactive tax planning.

You’ve got to work for the free money - but it just might worth every bit of effort.

Disclaimer: click here