The $50,000 Gift You Didn’t Know Your Mom Made

And How That $50,000 Gift Became Taxable Income to Mom

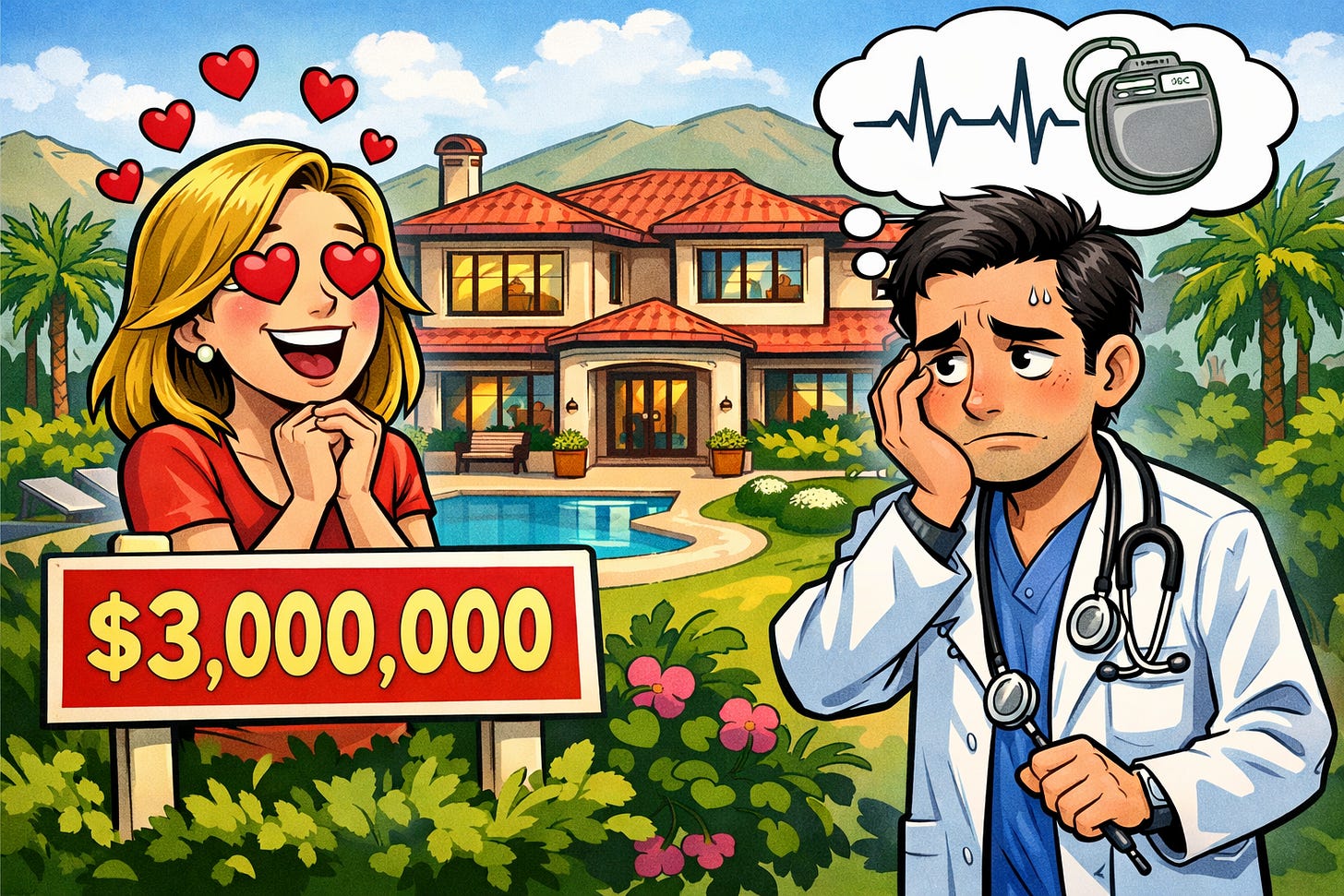

You worked so hard your entire life, finishing your training in your 30s - just in time to watch NVIDIA techies in their 20s pull in a cool half-mil a year.

Now you’re finally out of fellowship. You want to buy a house. And your parent wants to help.

Your generous mom, a retired cardiologist, says.

“I’ll loan you a $1M. Go get a nice house in Cupertino. No interest.”

It sounds generous. It sounds loving. It sounds… tax-efficient.

Well - maybe not that last part.

Why the IRS Cares About Your Family Loan

The IRS, our friendly tax collector, has a very simple worldview:

If money changes hands, it wants a cut.

That includes loans.

From the IRS’s perspective, a “real” loan is supposed to charge interest.

Why? Because interest creates taxable income.

No interest => no tax revenue.

And the IRS doesn’t like revenue gaps - especially ones created by interest-free family loans.

So Congress stepped in with a special rule that basically says:

“If you don’t charge interest, we’ll pretend you did.”

The Scenario: Welcome to Silicon Valley Realty

Let’s run a very real-world example.

You just finished a three-year residency followed by two fellowships totaling six more years.

You’re a newly minted electrophysiologist.

Your income trajectory? Sky high - north of $1M.

Your wife falls in love with a $3 million home in Silicon Valley.

So you have to buy it - “happy wife…”

Problem: no down payment.

Your mom — also a retired cardiologist — has done very well.

She offers to loan you $1 million.

Interest-free. Because… you are her only son.

Deal of a lifetime, right?

The Hidden Tax Trap: Foregone interest.

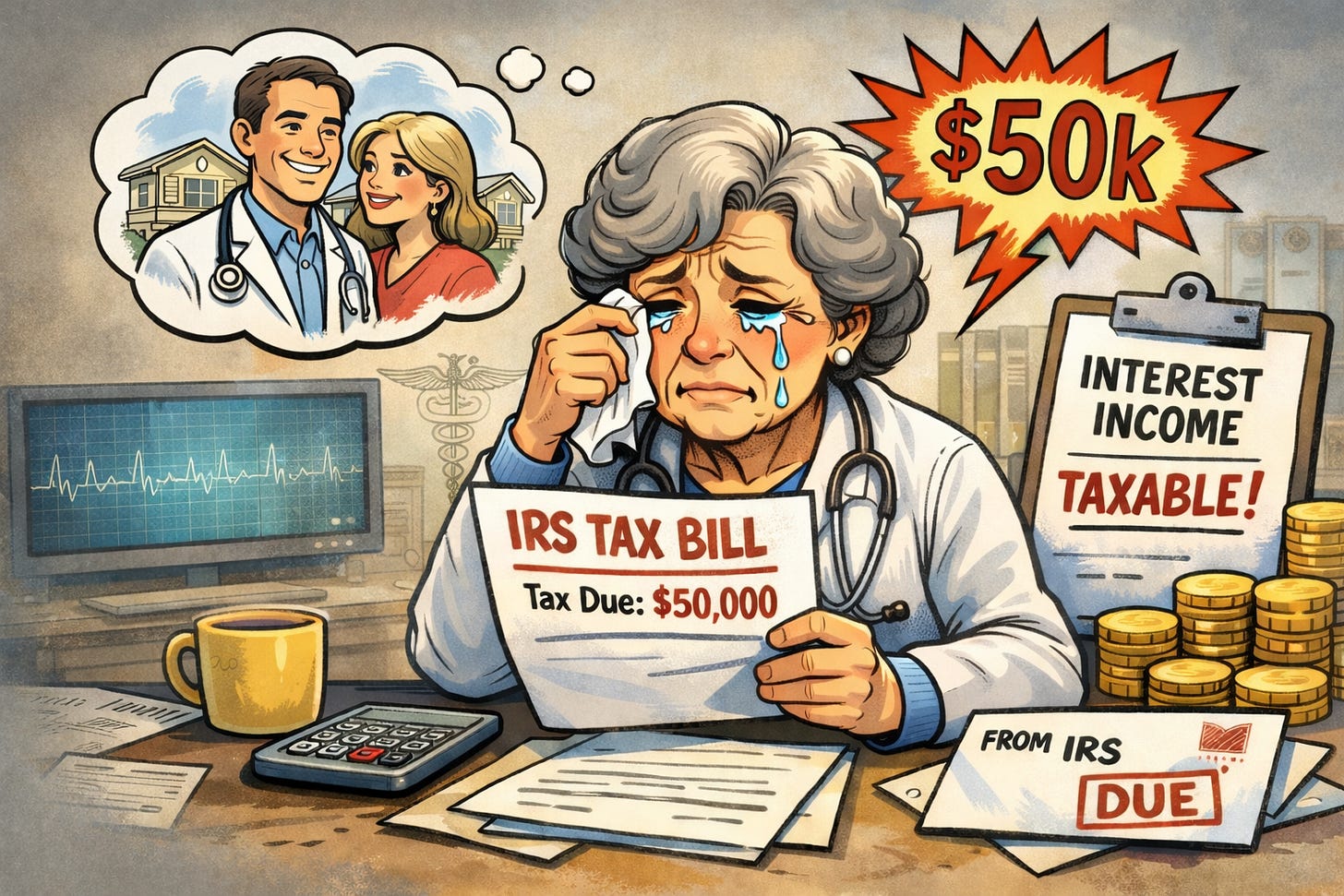

Under the tax rules for below-market loans (IRC §7872), the IRS calculates something called “foregone interest.”

They use a benchmark rate - the AFR.

Right now, that’s roughly 5%.

On a $1 million loan, that’s about $50,000 per year.

Here’s where things get weird.

The IRS pretends that:

Your mom gave you a $50,000 gift (but eligible for annual gift exclusion)

You immediately turned around and paid that $50,000 back to her as interest

Even though no money actually moved.

This is why tax pros call it phantom income.

Who Pays Tax on Money that Never Moved?

Your mom does.

That $50,000 is treated as interest income to her.

She must report it.

She pays tax on it.

Out of love, she helped you — and created taxable income for herself. Oh no!

You, the borrower, might be able to deduct the interest.

But that depends on how the loan is used, the property, and other limitations.

So the result is often lopsided:

Mom: unintentional gift followed by taxable income

Son: deduction maybe, maybe not

The Final Tax Scorecard

Your mom tried to help - but the IRS still wins.

This doesn’t mean family loans are bad.

It means interest-free family loans are rarely “free.”

The tax system doesn’t care about mom’s love.

It cares about tax revenue.

Final Thoughts

Before accepting (or offering) an interest-free family loan, pause.

What feels like generosity can quietly trigger:

gift tax reporting

taxable interest income

This is one of those situations where good intentions collide with notorious tax rules — and the rules usually win.

Disclaimer: click here