The $50,000 Missed Deduction

How Dr. Coach overlooked QBI deduction - and How a second opinion saved him $18,500!

In medicine, second opinions can change lives. A fresh set of eyes might spot something the first doctor missed—something that makes all the difference.

The same idea applies in tax.

Let me tell you a real story about how a second opinion on a tax return saved a rockstar physician-entrepreneur nearly $20,000.

The Story: Dr. Coach’s Missed Opportunity

Dr. Coach is a highly successful business coach for physician entrepreneurs. In 2024, his S corporation - his coaching business - earned $600,000 in net income. But that was just the warm-up — he was projecting $3 million in 2025. Wow!

He came to me for tax planning for the upcoming year. But before we looked ahead, I reviewed his 2024 tax return. And something immediately jumped out:

No Qualified Business Income (QBI) deduction!

What’s QBI?

The Qualified Business Income (QBI) deduction, also known as the Section 199A deduction, allows many business owners to deduct up to 20% of their business income — if certain conditions are met.

If you own a pass-through entity (like an S corp, sole proprietorship, or partnership), and your income qualifies, this deduction can be a major tax-saver.

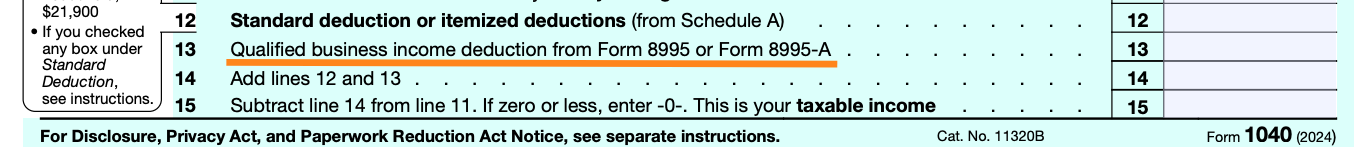

You’ll typically see it on Line 13 of Form 1040 (take a peek at your return if you’re curious).

But here’s the catch: it’s not automatic. Your tax preparer must properly calculate and report it - or it won’t appear at all.

The Problem: A $50,000 Deduction Left on the Table

When I reviewed his tax return, Line 13 of Form 1040 was blank - no QBI deduction taken.

So I dug deeper.

Qualifying for the QBI deduction can get tricky, especially for high-income earners. You have to consider:

The type of business

The amount of qualified business income (QBI)

The W-2 wages paid by the business

The amount the business spent on qualified business property.

Here’s what I found for Dr. Coach:

His business was not a Specified Service Trade or Business (SSTB)

Qualified Business Income (QBI): $600,000

W-2 wages paid to himself: $100,000

Business property purchased: just $4000 worth of electronics (a laptop and phone).

Because his income was well over the 2024 phaseout threshold ($383,900 for married filing jointly), and his business was not a SSTB, his deduction was subject to the wage/property limitation formula.

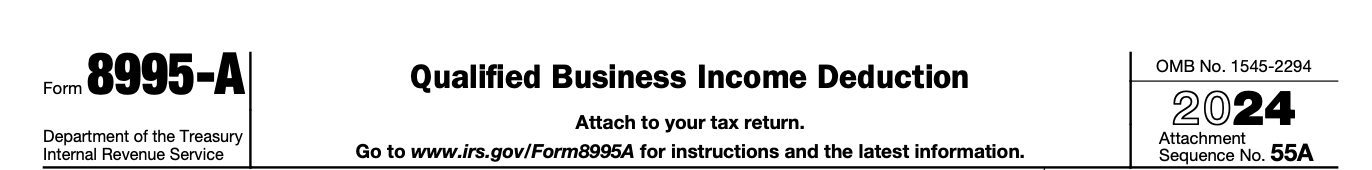

Here’s how that formula works (which is found on Form 8995-A)

Your QBI deduction is the lesser of:

20% of QBI, or

The greater of:

50% of W-2 wages, or

25% of wages + 2.5% of unadjusted basis of business property

Since he didn’t own much property, the 50% of wages rule was the only one that mattered.

Let’s do the math:

His QBI deduction is the lesser of

20% of $600,000 = $120,000 or

50% of $100,000 = $50,000.

So his QBI deduction should have been $50,000.

But that deduction? It was never claimed.

It was completely missing from his tax return.

At his 37% marginal tax rate, missing a $50,000 deduction meant an $18,500 overpayment.

Ouch!

The Fix: We Filed an Amended Return

Fortunately, we caught the error within the IRS’s three-year amendment window - just in time to make it right.

We filed a Form 1040-X for tax year 2024, correctly calculated the $50,000 QBI deduction, and submitted the revised return.

The result?

An $18,500 refund heading back to Dr. Coach.

Not bad for a second opinion that took less than an hour.

Lessons Learned

Here’s what Dr. Coach took away from the experience.

You don’t know what you don’t know

Even brilliant physicians and entrepreneurs can miss valuable tax savings without a trained second set of eyes. Experience and expertise matters.

QBI isn’t automatic

The IRS won’t apply this deduction for you. If your preparer overlooks it - or doesn’t fully understand the phaseout rules - you could miss out on thousands of dollars.

Second opinions aren’t just for medicine

In medicine, a second opinion can saves lives. In tax, they can save serious money. A fresh perspective might be all it takes to uncover missed opportunities.

Final Thought

If you’re a physician entrepreneur with a side hustle or business and you haven’t reviewed your past returns, you might be leaving money on the table.

A QBI deduction is one of the most commonly misapplied and overlooked tax breaks available to business owners.

Get a second opinion.

If you’re still within the IRS amendment window, a refund may be waiting for you.

Be like Dr. Coach.

Disclaimer: click here