Ways to Take Advantage of “One Big Beautiful Bill Act” – Part 1

New SALT Rules Could Save You $10K—Here’s How to Qualify

Let’s face it - half of you love it, and half of you hate it.

But no matter which side of the aisle you’re on, one thing is clear: as physicians, we owe it to ourselves to make the best of the financial realities we’re given.

Now that the “One Big Beautiful Bill Act” has officially passed the House, a wave of tax changes in coming - some of which could put thousands of extra dollars back into the hands of moderate to upper-middle income physician. But only if you understand the new changes and use strategic planning to your advantage.

One of the best talked-about features?

The long-awaited increase in the SALT deduction cap.

As with any tax reforms, there’s both opportunity and limitation baked in. In today’s post, I’ll break down what the new SALT cap means - and how physicians with moderately high income can use intentional, proactive tactics to make the most of it.

Let’s Start with the Basics: What Is SALT?

SALT stands for State and Local Taxes.

For federal tax purposes, it generally includes:

State income taxes

Property taxes

Certain Department Motor Vehicle (DMV) fees, such as California’s vehicle license fee.

Since 2018, the amount of SALT taxes you can deduct has been capped at $10,000 as part of your itemized deductions. So even if you pay $40,000 in SALT, only $10,000 reduces your taxable income. Not cool - especially for high earners in high-tax states like California.

If you take the standard deduction, the SALT cap doesn’t apply. But if you itemize, the cap can severely limit your deductions. (Want to learn more about standard deduction vs itemized deduction? check out my lectures.)

New SALT Cap: What It Means For You

With the newly signed bill, the SALT cap will increase to $40,000 starting in tax year 2025. For physicians in high-tax states like California, this could translate into real savings - if you qualify.

Let’s break it down

Case Study: California Physician with $500K Income

Let’s say a married couple in California earns $500,000.

Their SALT taxes could look like this:

$30,000 in California state income tax

$14,000 in property tax

$1,000 in DMV vehicle license fees

Total SALT paid: $50,000

They also pay $50,000 in mortgage interest, so they’re itemizing their deduction.

Under Current Law

SALT deduction capped at $10,000, so only $10,000 of their $50,000 in SALT is deductible

Mortgage interest deduction: $50,000

Total itemized deduction: $60,000

Under New Law (Expected 2025)

SALT deduction cap increases to $40,000

Mortgage interest deduction: $50,000

Total itemized deduction: $90,000

That’s an additional $30,000 increase in deductions.

Assuming a 35% federal marginal tax rate (new rate), this translates into a tax savings of about $10,000. That’s real money.

But Here’s the Catch: The Income Phase-Out

The new $40,000 SALT cap doesn’t apply to everyone equally. It starts to phase out once your AGI exceeds $500,000 (for married filing jointly).

Here’s how the phase-out works:

For every dollar your AGI goes over $500,000, you lose 30 cents of the SALT deduction cap.

For example:

If your AGI is $600,000, you’re $100,000 over the threshold.

30% of $100,000 = $30,000

$40,000 SALT cap - $30,000 = $10,000 SALT deduction, same as today

So in this case, you’re right back to the current $10,000 cap - no change. Bummer!

So What Can You Do About It?

Simple: You plan.

To unlock the full benefit of the new $40,000 SALT cap, your AGI needs to stay at or below $500,000 — or as close as possible.

The good news? You have multiple legal tools to either:

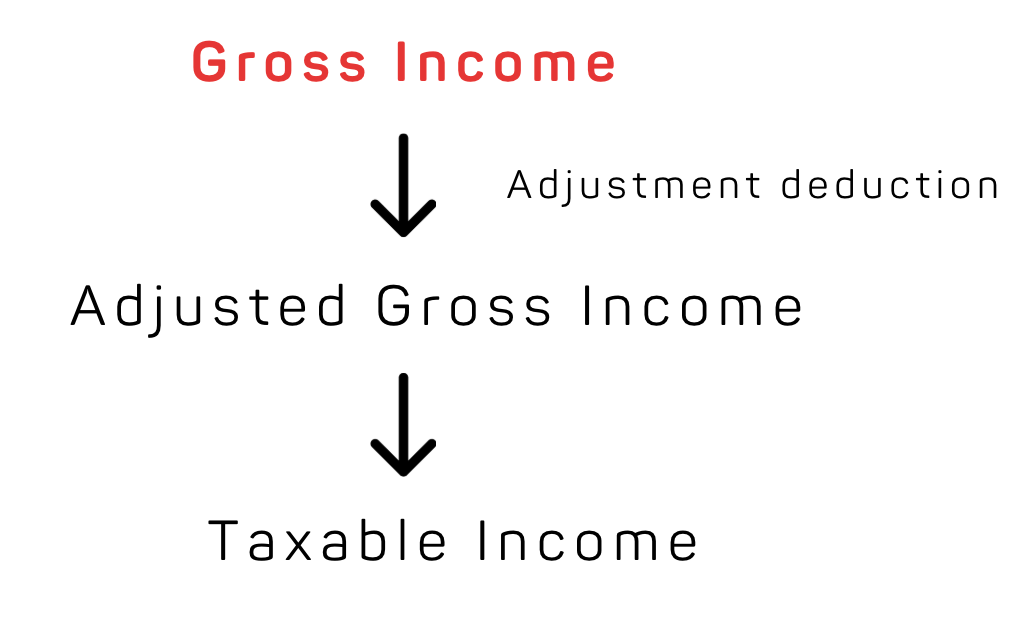

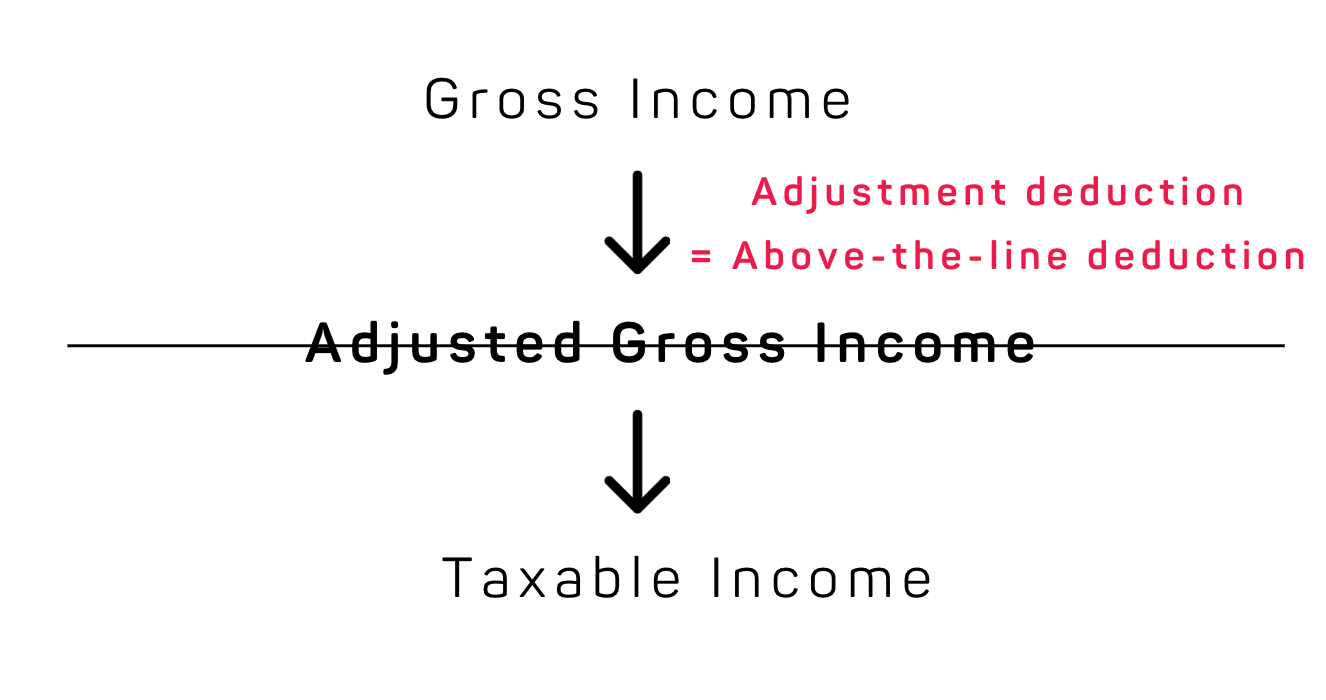

Exclude income so it never hits your AGI, or

Claim adjustment deductions (aka above-the-line deduction) that reduces AGI directly.

Let’s break it down:

1. Reduce Gross Income with Exclusions

Some types of income are completely excluded from gross income - which means they don’t show up in AGI at all. That’s incredibly valuable when your goal is to stay under the $500,000 AGI threshold to claim the full SALT deduction.

Here are two strategies worth knowing:

1.Section 121 Home Sale Exclusion

If you sell your primary home after living there for at least 2 of the last 5 years, you can exclude up to $500,000 of gain (if married filing jointly). That excluded gain never shows up on your return, which helps keep AGI low in the year of sale. Planning the sale of a home with this rule. in mind can be an effective way to manage AGI in a high-income year.

2.The Augusta Rule (Section 280A(g))

You can rent out your home for up to 14 days per year, and the income is completely excluded from gross income. It’s not reported, not taxed, and doesn’t raise your AGI. If you’re heading to Hawaii or Europe on vacation, consider renting your home while you’re away - this is a clean way to generate tax-free income while preserving SALT eligibility.

2. Lower AGI with Adjustment Deductions

Adjustment deductions reduce AGI directly - before you even get to itemized deductions. If you have 1099 income or own a business, you have more control over what gets deducted.

Here are a few strategies worth knowing:

1.Solo 401(k) Contributions

If you earn 1099 income from locums, moonlighting, or consulting, you can contribute to a Solo 401(k). In 2025, you can defer up to $23,500 as an elective deferral, plus an additional employer contribution based on net earnings. All contributions are above-the-line deductions and help reduce AGI.

2.Self-Employed Business Expenses

You can also reduce AGI by timing and documenting your business expenses property.

Pay invoices before year-end.

Prepay expenses like CME courses, licensing fees, or subscriptions.

Turn personal travel into a legitimate business trip - if you’re attending a conference or meeting with clients, much of your travel can be deducted. The cleaner your records, the more confidently you can claim deductions.

What If You’re W-2 Only?

Even if you don’t have 1099 income, you still have options.

Invest in oil and gas partnership

This is one of the few ways to “buy” an adjustment deduction. Oil and gas partnerships often pass through intangible drilling costs (IDCs), which are considered adjustment deductions.

For example:

If you invest $100,000 into a oil and gas deal, you could receive around $85,000 of ICD deduction, directly reducing your AGI. You can scale your investment amount target a specific AGI and stay under the $500,000 SALT cap threshold. Just make sure you understand the risks, liquidity issues, and long-term tax consequences before jumping in.

Final Thoughts

The new SALT cap increase is meaningful—but it isn’t automatic. It’s a targeted benefit that rewards those who plan ahead.

If your AGI hovers near the $500,000 line, your tax planning choices will determine whether you get just $10,000 or the full $40,000 in SALT deductions. That difference could mean an extra $10,000 in your pocket each year while this provision lasts

That’s where a clear understanding of how individual taxation works gives you leverage.

Know that moves the AGI.

Use income-exclusion rules and adjustment deductions strategically

Defer, deduct or exclude with intention.

When Congress opens a narrow window, it’s up to you to walk through it - strategy in hand, savings in sight.

Disclaimer: click here