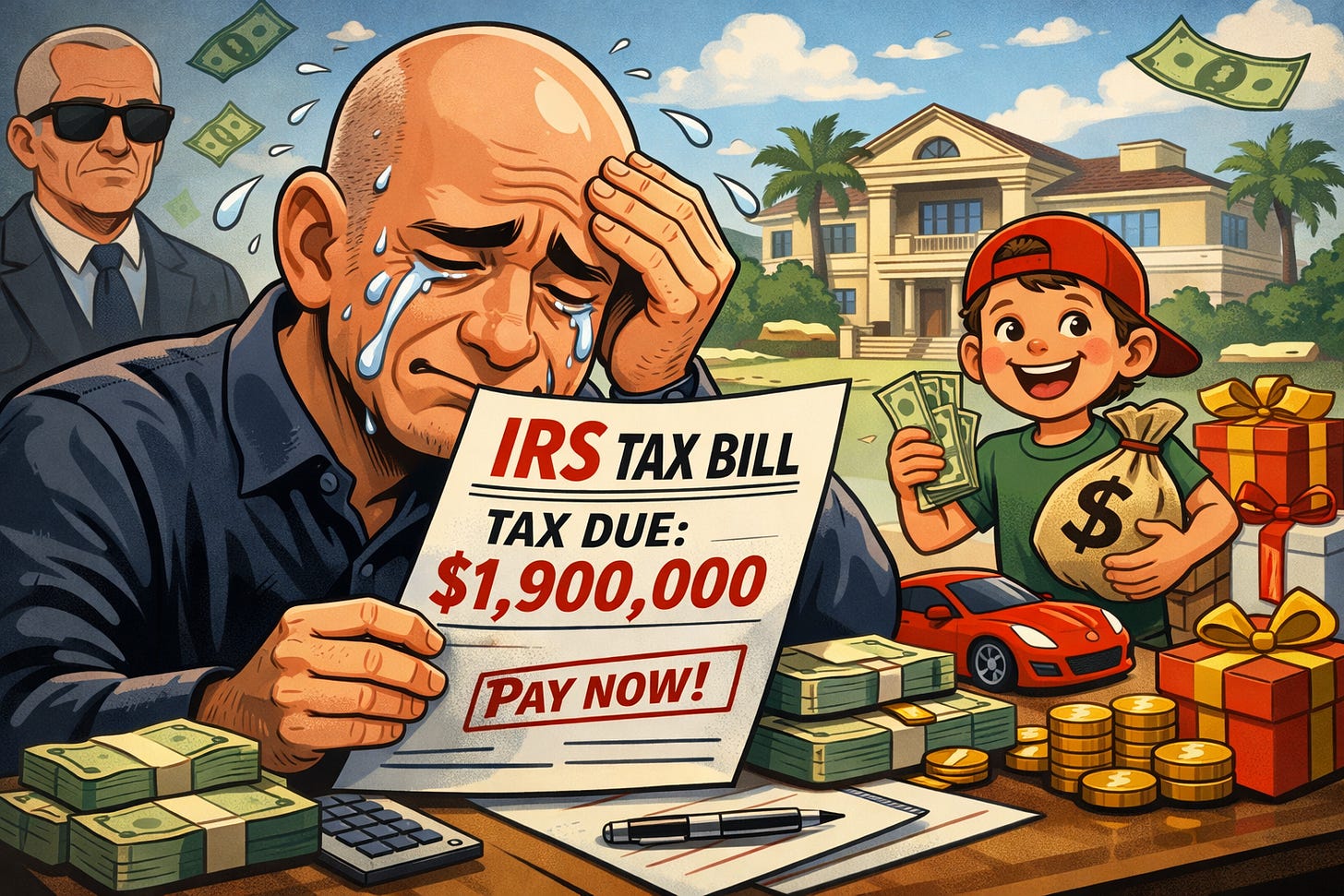

Why Giving Your Grandkid $2 Million Can Cost You $1.9 Million in Taxes

A real-life look at how gift and generation-skipping taxes can nearly wipe out a fortune without planning

Super-wealthy doctors (and billionaires) have a very different tax problem than a worker-bee doctor like me.

Their biggest problem is not income tax.

It’s transfer tax - gift tax, estate tax, and generation skipping (GST) tax. These taxes are triggered when large amounts of wealth move to the next generation through gifts or inheritances.

And without property planning, the results can be brutal.

Very. Brutal.

Why Transfer Taxes Hurt So Much

Once you use up your lifetime gift and estate exemption (currently ~$15m per person), every additional dollar you transfer is subject to the highest tax rate in the entire tax code:

40%.

Ouch!

But things get truly insane when you skip a generation - for example, you give money directly to a grandchild instead of a child.

Why?

Because a second tax layer kicks in: the generation-skipping transfer (GST) tax.

In extreme cases, the tax bill nearly equal the amount you’re trying to give away.

Yes, I am for real (Sorry, Miss Jackson, Whoo - Outkast)…

A No-Planning Nightmare: The Bezos Thought Experiment

Let’s assume the following:

Jeff Bezos has already used up all of his lifetime gift and estate exemption

He gives $2,000,000 to one grandchild

He agrees to pay all the transfer taxes himself (both gift tax and GST tax)

Now let’s walk through what happens.

Step 1: Determining the Taxable Gift

Assume there is no $19,000 annual exclusion available.

That means Bezos has a $2,000,000 taxable gift.

Gift tax rate: 40%

Gift tax owed under IRC §2502:

$2,000,000 × 40% = $800,000

Painful, but still manageable… right?

He’s rich after all.

Not so fast.

Step 2: The Generation-Skipping Transfer Tax (The One Nobody Talks About)

This is territory most taxpayers have never seen.

Because the gift is made directly to a grandchild, it is considered a “direct skip” under the GST tax rules.

That triggers an entirely separate tax.

GST tax rate: 40%

GST tax owed under IRC §§2601 and 2623:

$2,000,000 × 40% = $800,000

At this point, Bezos already owes the government $1,600,000 on a $2,000,000 gift.

But it’s still not over.

Yes. Still not over.

Step 3: Paying the GST Tax Creates… Another Taxable Gift

This is where the tax code starts to go loco.

When Bezos pays the $800,000 GST tax, that payment itself is treated as a new taxable gift.

Yes - the tax on the gift becomes another gift. OMG.

That $800,000 GST tax payment is now subject to gift tax.

Additional gift tax owed:

$800,000 × 40% = $320,000

At this point, most people reread this rules just to make sure they are not hallucinating.

They’re not.

Final Tally: Almost a 100% Tax

Here’s how it shakes out:

Gift tax on original $2,000,000 gift: $800,000

GST tax on the direct skip: $800,000

Additional gift tax caused by paying the GST tax: $320,000

Total tax due: $1,920,000

To give a grandchild $2,000,000, Bezos has to write checks totaling almost the same amount to the government.

That is not a typo.

Why the Ultra-Wealthy Obsess Over Estate Planning

This is why wealthy families spend years — and a ton of money — planing their estates.

This is why trusts exist.

This is why generation-skipping strategies matter.

This is why charitable giving is everywhere at the ultra-high end.

It’s not generosity alone.

It’s math.

And if you don’t plan, the transfer tax system will happily take nearly everything.

Disclaimer: click here